Get 69% Off on Cloud Hosting : Claim Your Offer Now!

- Products

-

Compute

Compute

- Predefined TemplatesChoose from a library of predefined templates to deploy virtual machines!

- Custom TemplatesUse Cyfuture Cloud custom templates to create new VMs in a cloud computing environment

- Spot Machines/ Machines on Flex ModelAffordable compute instances suitable for batch jobs and fault-tolerant workloads.

- Shielded ComputingProtect enterprise workloads from threats like remote attacks, privilege escalation, and malicious insiders with Shielded Computing

- GPU CloudGet access to graphics processing units (GPUs) through a Cyfuture cloud infrastructure

- vAppsHost applications and services, or create a test or development environment with Cyfuture Cloud vApps, powered by VMware

- Serverless ComputingNo need to worry about provisioning or managing servers, switch to Serverless Computing with Cyfuture Cloud

- HPCHigh-Performance Computing

- BaremetalBare metal refers to a type of cloud computing service that provides access to dedicated physical servers, rather than virtualized servers.

-

Storage

Storage

- Standard StorageGet access to low-latency access to data and a high level of reliability with Cyfuture Cloud standard storage service

- Nearline StorageStore data at a lower cost without compromising on the level of availability with Nearline

- Coldline StorageStore infrequently used data at low cost with Cyfuture Cloud coldline storage

- Archival StorageStore data in a long-term, durable manner with Cyfuture Cloud archival storage service

-

Database

Database

- MS SQLStore and manage a wide range of applications with Cyfuture Cloud MS SQL

- MariaDBStore and manage data with the cloud with enhanced speed and reliability

- MongoDBNow, store and manage large amounts of data in the cloud with Cyfuture Cloud MongoDB

- Redis CacheStore and retrieve large amounts of data quickly with Cyfuture Cloud Redis Cache

-

Automation

Automation

-

Containers

Containers

- KubernetesNow deploy and manage your applications more efficiently and effectively with the Cyfuture Cloud Kubernetes service

- MicroservicesDesign a cloud application that is multilingual, easily scalable, easy to maintain and deploy, highly available, and minimizes failures using Cyfuture Cloud microservices

-

Operations

Operations

- Real-time Monitoring & Logging ServicesMonitor & track the performance of your applications with real-time monitoring & logging services offered by Cyfuture Cloud

- Infra-maintenance & OptimizationEnsure that your organization is functioning properly with Cyfuture Cloud

- Application Performance ServiceOptimize the performance of your applications over cloud with us

- Database Performance ServiceOptimize the performance of databases over the cloud with us

- Security Managed ServiceProtect your systems and data from security threats with us!

- Back-up As a ServiceStore and manage backups of data in the cloud with Cyfuture Cloud Backup as a Service

- Data Back-up & RestoreStore and manage backups of your data in the cloud with us

- Remote Back-upStore and manage backups in the cloud with remote backup service with Cyfuture Cloud

- Disaster RecoveryStore copies of your data and applications in the cloud and use them to recover in the event of a disaster with the disaster recovery service offered by us

-

Networking

Networking

- Load BalancerEnsure that applications deployed across cloud environments are available, secure, and responsive with an easy, modern approach to load balancing

- Virtual Data CenterNo need to build and maintain a physical data center. It’s time for the virtual data center

- Private LinkPrivate Link is a service offered by Cyfuture Cloud that enables businesses to securely connect their on-premises network to Cyfuture Cloud's network over a private network connection

- Private CircuitGain a high level of security and privacy with private circuits

- VPN GatewaySecurely connect your on-premises network to our network over the internet with VPN Gateway

- CDNGet high availability and performance by distributing the service spatially relative to end users with CDN

-

Media

-

Analytics

Analytics

-

Security

Security

-

Network Firewall

- DNATTranslate destination IP address when connecting from public IP address to a private IP address with DNAT

- SNATWith SNAT, allow traffic from a private network to go to the internet

- WAFProtect your applications from any malicious activity with Cyfuture Cloud WAF service

- DDoSSave your organization from DoSS attacks with Cyfuture Cloud

- IPS/ IDSMonitor and prevent your cloud-based network & infrastructure with IPS/ IDS service by Cyfuture Cloud

- Anti-Virus & Anti-MalwareProtect your cloud-based network & infrastructure with antivirus and antimalware services by Cyfuture Cloud

- Threat EmulationTest the effectiveness of cloud security system with Cyfuture Cloud threat emulation service

- SIEM & SOARMonitor and respond to security threats with SIEM & SOAR services offered by Cyfuture Cloud

- Multi-Factor AuthenticationNow provide an additional layer of security to prevent unauthorized users from accessing your cloud account, even when the password has been stolen!

- SSLSecure data transmission over web browsers with SSL service offered by Cyfuture Cloud

- Threat Detection/ Zero DayThreat detection and zero-day protection are security features that are offered by Cyfuture Cloud as a part of its security offerings

- Vulnerability AssesmentIdentify and analyze vulnerabilities and weaknesses with the Vulnerability Assessment service offered by Cyfuture Cloud

- Penetration TestingIdentify and analyze vulnerabilities and weaknesses with the Penetration Testing service offered by Cyfuture Cloud

- Cloud Key ManagementSecure storage, management, and use of cryptographic keys within a cloud environment with Cloud Key Management

- Cloud Security Posture Management serviceWith Cyfuture Cloud, you get continuous cloud security improvements and adaptations to reduce the chances of successful attacks

- Managed HSMProtect sensitive data and meet regulatory requirements for secure data storage and processing.

- Zero TrustEnsure complete security of network connections and devices over the cloud with Zero Trust Service

- IdentityManage and control access to their network resources and applications for your business with Identity service by Cyfuture Cloud

-

-

Compute

- Solutions

-

Solutions

Solutions

-

Cloud

Hosting

Cloud

Hosting

-

VPS

Hosting

VPS

Hosting

-

GPU Cloud

-

Dedicated

Server

Dedicated

Server

-

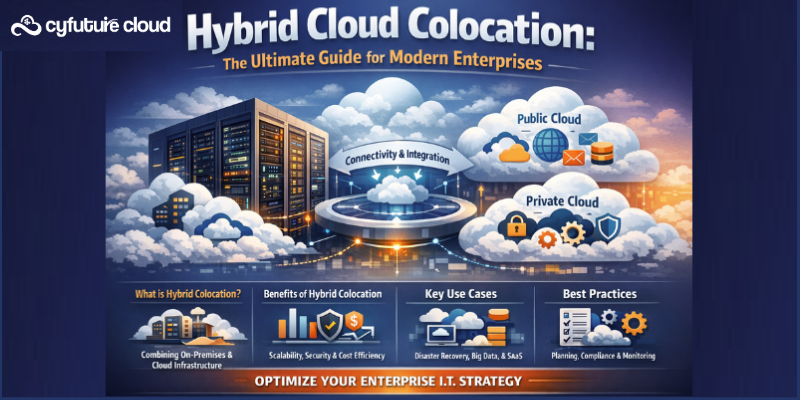

Server

Colocation

Server

Colocation

-

Backup as a Service

Backup as a Service

-

CDN

Network

CDN

Network

-

Window

Cloud Hosting

Window

Cloud Hosting

-

Linux

Cloud Hosting

Linux

Cloud Hosting

-

Managed Cloud Service

-

Storage as a Service

-

VMware

Public Cloud

VMware

Public Cloud

-

Multi-Cloud

Hosting

Multi-Cloud

Hosting

-

Cloud

Server Hosting

Cloud

Server Hosting

-

Bare

Metal Server

Bare

Metal Server

-

Virtual

Machine

Virtual

Machine

-

Magento

Hosting

Magento

Hosting

-

Remote Backup

-

DevOps

DevOps

-

Kubernetes

Kubernetes

-

Cloud

Storage

Cloud

Storage

-

NVMe Hosting

-

DR

as s Service

DR

as s Service

-

-

Solutions

- Marketplace

- Pricing

- Resources

- Resources

-

By Product

Use Cases

-

By Industry

- Company

-

Company

Company

-

Company

Cloud Computing Investment Strategies: How to Make the Most of Your Money

Table of Contents

Overview:

In the recent advanced technology of landscape cloud computing has become an integral part. There are numerous benefits of cloud computing, including increased agility, flexibility, scalability, and cost savings. These benefits have made cloud computing an attractive investment opportunity for both individual and institutional investors.

However, investing in cloud computing requires a certain level of knowledge and understanding of the market. There are methods available to enhance ROI and maximize the value of your cloud budget, which is a fortunate circumstance.

In this blog post, we will discuss cloud computing investment strategies and how to make the most of your money when investing in this fast-growing industry.

Understanding Cloud Computing and the Market

Before investing in cloud computing, it is essential to understand what cloud computing is and how the market operates.

Cloud computing is the delivery of computing services, including servers, storage, databases, networking, software, and analytics over the internet. Cloud computing allows businesses to use these services on a pay-as-you-go basis rather than investing in expensive on-premises infrastructure.

According to the Fortune Business Insights, the global cloud computing market is projected to grow from $480.04 billion in 2022 to $1,712.44 billion by 2029, at a CAGR of 19.9% in forecast period.

The cloud computing market is composed of several segments, including Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS). Each segment has its own unique characteristics, and investors should understand these differences to make informed investment decisions.

Investment Strategies For Cloud Computing

There are several cloud computing investment strategies that investors can use to make the most of their money. The following are some of the most effective strategies for investing in cloud computing:

Invest in cloud computing stocks

Investing in cloud computing stocks is one of the most direct ways to invest in the industry. Cloud computing stocks are stocks of companies that provide cloud computing services, such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform.

Investors can choose to invest in individual cloud computing stocks or in exchange-traded funds (ETFs) that track the performance of the cloud computing industry. Investing in ETFs allows investors to diversify their portfolio and reduce risk.

Focus on established cloud computing companies

Investors should consider focusing on established cloud computing companies that have a proven track record of success. These companies have a competitive advantage and are well-positioned to weather economic downturns and market volatility.

Established cloud computing companies also have a solid customer base, which can provide a steady stream of revenue. Examples of established cloud computing companies include Amazon Web Services, Microsoft Azure, and Google Cloud Platform.

Look for growth opportunities

Investors should also consider investing in cloud computing companies that have significant growth potential. These companies are typically smaller and may be in the early stages of developing their cloud computing services. However, they may have a unique product or service that sets them apart from competitors and could lead to significant growth in the future.

Investors should look for companies that are focused on developing new technology, have a strong management team, and have a clear strategy for growth. These companies may be riskier investments but could offer higher potential returns.

Invest in companies that support cloud computing

Investors can also invest in companies that support the cloud computing industry, such as companies that provide networking equipment, data center services, or security solutions. These companies may not be as directly tied to the cloud computing market as cloud computing providers, but they play an essential role in the industry.

Investing in these companies can provide exposure to the cloud computing market while also diversifying the portfolio. Examples of companies that support the cloud computing industry include Cisco Systems, Equinix, and Palo Alto Networks.

Consider international cloud computing markets

Investors should also consider investing in international cloud computing markets, such as Europe and Asia. These markets are growing rapidly and offer significant investment opportunities.

Investing in international markets can also provide diversification benefits and reduce risk. However, investors should be aware of the unique risks associated with international investments, such as currency risk and political risk.

Use dollar-cost averaging

Dollar-cost averaging is a strategy where investors invest a fixed amount of money at regular intervals, regardless of the market’s performance. This strategy can help reduce the impact of market volatility and can help investors build a diversified portfolio over time.

Investors can use dollar-cost averaging to invest in cloud computing stocks or ETFs over a period of months or years. This strategy can help reduce the impact of short-term market fluctuations and can help investors build a more stable portfolio over the long term.

Risks and Challenges of Cloud Computing Investments

Some of the key risks and challenges of cloud computing investments, along with potential solutions to address these risks:

|

Risk/Challenge |

Potential Solutions |

|

Market volatility |

Invest for the long-term, diversify your portfolio, don’t panic during market downturns |

|

Regulatory and legal risks |

Research the regulatory and legal risks associated with cloud computing investments, invest in companies with strong compliance programs and a good track record of regulatory compliance |

|

Cybersecurity risks |

Research the cybersecurity risks associated with cloud computing investments, invest in companies with strong cybersecurity programs and a good track record of protecting customer data |

|

Economic risks |

Be aware of the economic risks associated with cloud computing investments, consider diversifying your portfolio to reduce risk |

|

Interoperability and data portability challenges |

Invest in companies that prioritize interoperability and data portability, support open standards and APIs |

|

Vendor lock-in |

Research vendor lock-in risks associated with cloud computing investments, consider investing in companies that support multi-cloud strategies and offer flexible pricing and service options |

|

Cloud migration challenges |

Invest in companies that offer strong migration support and services, consider working with a cloud migration specialist |

|

Talent shortage |

Invest in companies that offer training and certification programs for cloud computing professionals, consider developing your own in-house talent or working with a managed service provider |

|

Data privacy and sovereignty concerns |

Research the data privacy and sovereignty regulations in the markets you’re investing in, invest in companies with strong data privacy and security programs and a good track record of protecting customer data |

|

Scalability challenges |

Invest in companies that offer scalable cloud computing services and have a track record of handling large-scale workloads, consider working with a managed service provider to handle scalability challenges |

|

Operational challenges |

Research the operational challenges associated with cloud computing investments, invest in companies with strong operational processes and a good track record of uptime and availability |

|

Cost management challenges |

Develop a cost management strategy that takes into account factors such as usage, pricing models, and optimization, consider working with a cloud cost management specialist or using cost management tools |

|

Innovation and technology risks |

Research the innovation and technology risks associated with cloud computing investments, invest in companies with a track record of innovation and a strong R&D program, consider diversifying your portfolio across different technology sectors |

|

Environmental and sustainability concerns |

Research the environmental and sustainability policies and practices of the companies you’re investing in, consider investing in companies that prioritize sustainability and have a track record of reducing their environmental impact |

Conclusion:

For long-term growth and diversification, investing in cloud computing can be a smart choice. However, before investing in the cloud investors should understand the things like market risks and challenges because these are associated with it. By using the strategies outlined in this blog post and by conducting thorough research, investors can make informed investment decisions and make the most of their money in the cloud computing industry.

Recent Post

Stay Ahead of the Curve.

Join the Cloud Movement, today!

© Cyfuture, All rights reserved.

Send this to a friend

Pricing

Calculator

Pricing

Calculator

Power

Power

Utilities

Utilities VMware

Private Cloud

VMware

Private Cloud VMware

on AWS

VMware

on AWS VMware

on Azure

VMware

on Azure Service

Level Agreement

Service

Level Agreement