Table of Contents

- Introduction: The Digital Infrastructure Revolution

- What is Data Center Capacity and Why Does It Matter?

- Mumbai’s Global Standing: The Numbers Tell the Story

- Five Critical Factors Driving Mumbai’s Data Center Boom

- The Broader Data Center India Market Context

- Cyfuture Cloud: Powering India’s Digital Transformation

- Challenges and Opportunities Ahead

- What Technology Leaders Should Know

- The Road Ahead: 2025-2030 Outlook

- Accelerate Your Digital Journey with Mumbai’s World-Class Infrastructure

- Frequently Asked Questions (FAQs)

- Why does Mumbai rank 6th globally in data center capacity under construction?

- What is the total data center capacity in Mumbai?

- How does Data Center India market compare globally?

- What submarine cable projects are landing in Mumbai?

- Which companies are investing in Mumbai data centers?

- What are the cost advantages of Mumbai data centers?

- How does Mumbai compare to Pune and Bengaluru for data centers?

- What role does AI play in Mumbai’s data center growth?

- Is Mumbai’s data center infrastructure reliable for enterprise workloads?

Introduction: The Digital Infrastructure Revolution

Were you searching for insights on why Mumbai has emerged as a global data center powerhouse?

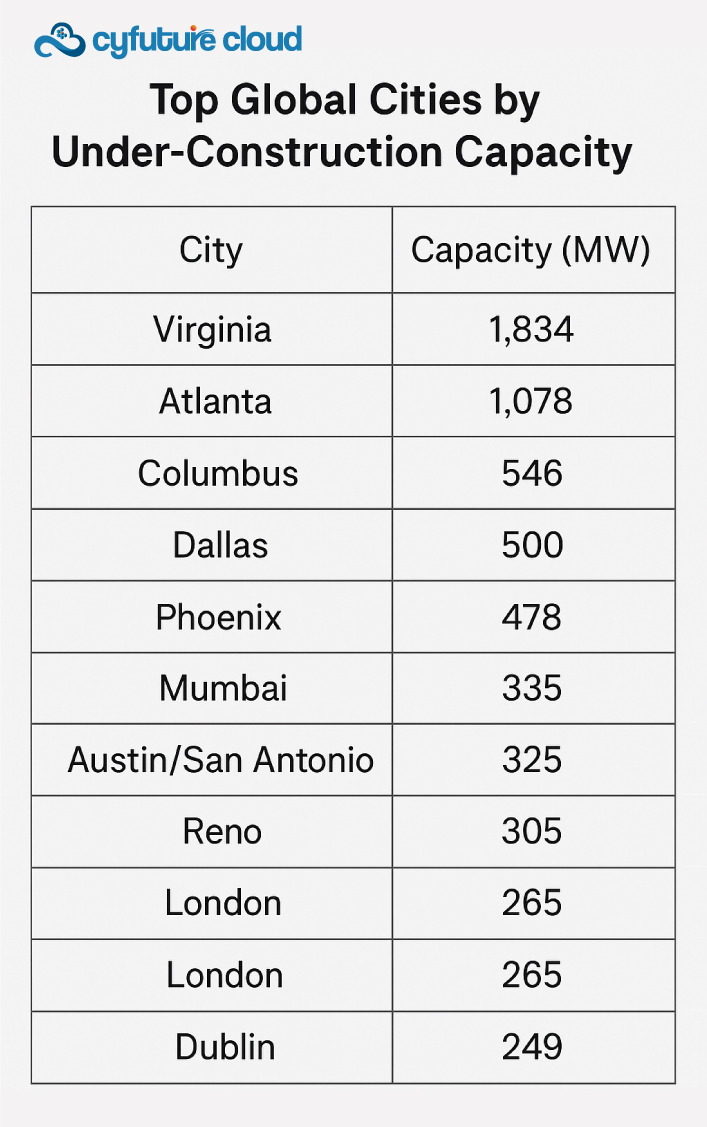

Mumbai has achieved a remarkable milestone, securing the 6th position globally in under-construction data center capacity, outpacing established hubs like London and Dublin. With 335 megawatts (MW) of capacity under development, the city accounts for 42% of India’s total under-construction data center infrastructure, positioning itself as a critical node in the Asia-Pacific digital ecosystem.

This isn’t just a statistic—it’s a testament to India’s digital transformation trajectory. As enterprises, hyperscalers, and technology leaders seek robust infrastructure to power AI workloads, cloud computing, and real-time applications, Mumbai has emerged as the epicenter of this digital revolution.

Here’s the thing:

The global data center landscape is experiencing unprecedented growth, driven by exponential increases in data consumption, AI adoption, and cloud migration. Mumbai’s rise reflects broader market dynamics that are reshaping how organizations approach digital infrastructure.

What is Data Center Capacity and Why Does It Matter?

A data center is a specialized facility that houses computing systems, storage infrastructure, and networking equipment to support critical business operations, cloud services, and digital applications. Data center capacity, measured in megawatts (MW) or IT load, represents the total power available to support these computing operations.

For the Data Center India market, capacity expansion directly correlates with:

- Cloud computing scalability for enterprises and hyperscalers

- AI and machine learning workload processing capabilities

- Digital service delivery speed and reliability

- Economic growth through technology investments and job creation

Mumbai’s 335 MW under-construction capacity will expand its operational infrastructure by 62%, fundamentally transforming the city’s digital backbone.

Mumbai’s Global Standing: The Numbers Tell the Story

The Top 10 Global Rankings

According to Cushman & Wakefield’s Global Data Center Market Comparison 2025 report, which evaluated 97 global cities, Mumbai has secured an impressive position:

Let me be clear:

Mumbai is the only Indian city—and one of just two Asian cities—in the global top 10 for under-construction capacity. This positioning underscores the city’s strategic importance as enterprises and cloud service providers race to establish presence in the region.

Asia-Pacific Dominance

The Asia-Pacific region is experiencing explosive growth. Here’s what the data reveals:

- 10 of the world’s 30 largest data center markets are now in Asia-Pacific

- The region added 1.6 GW of new capacity in 2024

- Total operational capacity reached 12.2 GW by end of 2024

- 14.4 GW of additional capacity is under construction or planned

Mumbai ranks as the 7th most established data center market in Asia-Pacific, demonstrating consistent growth alongside established hubs like Tokyo, Singapore, and Shanghai.

Five Critical Factors Driving Mumbai’s Data Center Boom

1. Strategic Geographic Location and Connectivity Infrastructure

Mumbai’s position as India’s financial capital and primary internet gateway creates a natural advantage. The city serves as:

But here’s where it gets interesting:

Three major undersea cable projects are landing in Mumbai in 2025, fundamentally transforming the city’s connectivity profile:

- 2Africa Pearls: One of the world’s longest submarine cable systems at 45,000+ km, connecting 33 countries across Africa, Middle East, and Asia with 180 terabits per second (Tbps) capacity

- India-Asia-Express (IAX): Spanning 16,000+ km, connecting Mumbai to Singapore, Malaysia, Thailand, and Sri Lanka with 200+ Tbps capacity

- India-Europe-Express (IEX): Covering 9,775 km, linking India with Europe via the Persian Gulf with 200+ Tbps capacity

These projects will quadruple India’s internet capacity, with Mumbai serving as the primary landing hub. This infrastructure positions Mumbai as a major connectivity hub in Southeast Asia, enabling low-latency access to global markets.

As industry expert Gautam Saraf, Executive Managing Director at Cushman & Wakefield, notes:

“Mumbai has firmly positioned itself among the top global markets. India’s data center sector has attracted prominent international operators and investors, even as domestic players continue to expand capacity.”

2. Power Availability and Infrastructure Readiness

Power is the lifeblood of data centers. Here’s why Mumbai excels:

- Reliable power infrastructure with established grid connectivity

- Government incentives for data center development including power subsidies

- Lower construction costs compared to peers ($6.60 per watt vs. Tokyo and Sydney)

- Land availability in key corridors like Navi Mumbai and Airoli

The Maharashtra government’s data center policy provides:

- Single-window clearance mechanisms

- Infrastructure status benefits

- Tax incentives for large-scale investments

- Fast-track approval processes

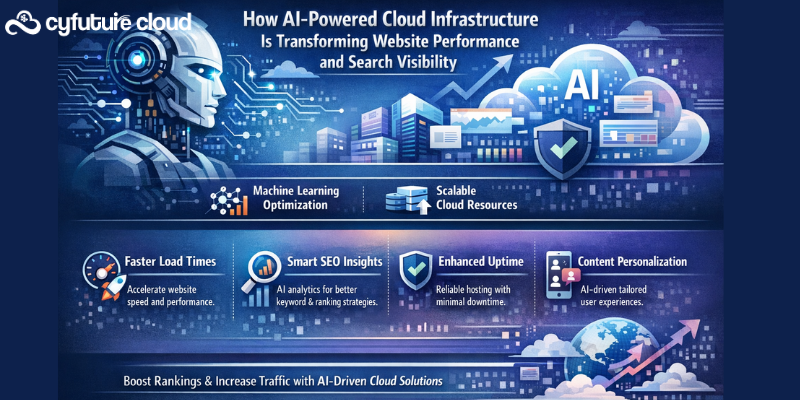

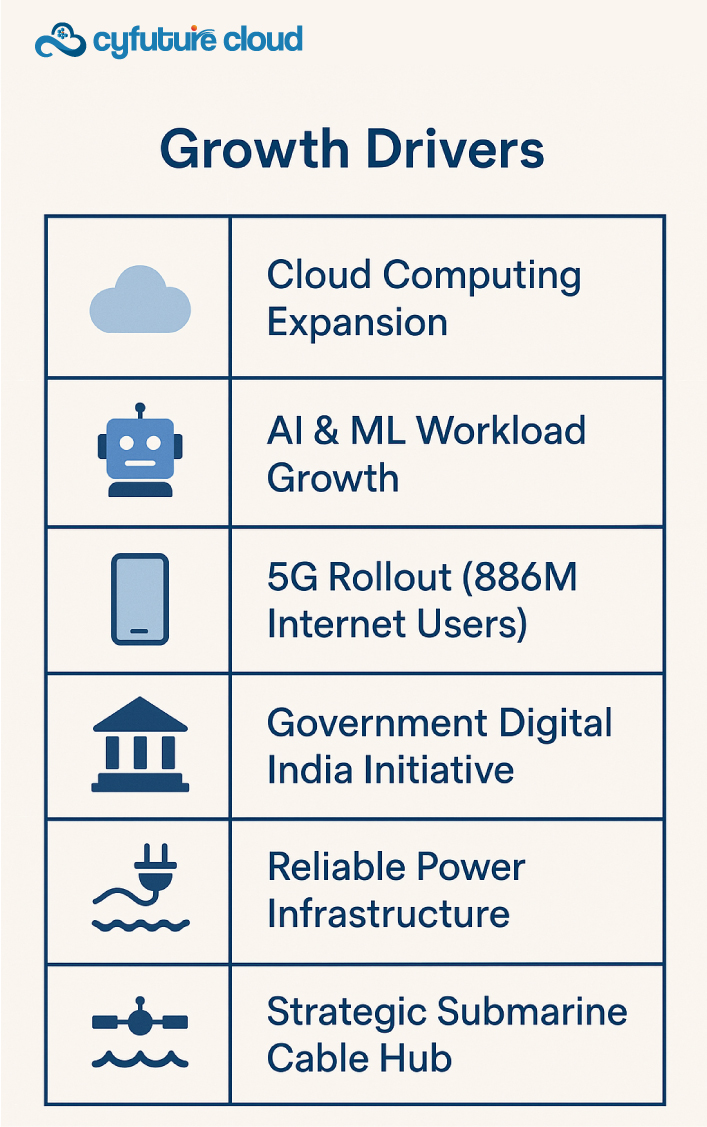

3. Explosive Growth in Cloud Computing and AI Workloads

The demand side of the equation is equally compelling:

India’s Data Center Market Statistics:

- Market valued at $8.01 billion in 2024

- Expected to reach $24.78 billion by 2033

- Growing at 13.37% CAGR (2025-2033)

- Operational capacity reached 1,110 MW in 2024

- Projected to surge to 1,600 MW by end of 2025

The AI revolution is a primary catalyst:

- Cloud Service Providers have pre-committed 800 MW of capacity for AI workloads

- Dedicated AI demand expected between 650-800 MW from 2024-2026

- Hyperscalers accounting for 22% of total data center stock in 2024

Think about it:

Every ChatGPT query, every autonomous vehicle data point, every streaming session—all require massive computational resources. Mumbai’s infrastructure is being designed to handle these next-generation workloads.

4. Major Enterprise and Hyperscaler Investments

The investment landscape tells a compelling story:

Global Technology Giants:

- Amazon Web Services (AWS): $12.7 billion investment commitment

- Microsoft: Expanding Mumbai data center footprint

- Google: $15 billion investment plan in India, 8-story 381,000 sq ft facility in Navi Mumbai

- Princeton Digital Group: $1 billion investment for Mumbai and Chennai expansion

Domestic Leaders:

- Reliance Industries: $30 billion, 3 GW AI campus in Jamnagar

- AdaniConneX: $1.44 billion for 1 GW renewable-focused platform

- STT GDC: $3.2 billion expansion plan for 550 MW capacity

- Sify Technologies: $360 million in data center investments

A Reddit user in r/india recently commented:

“The data center boom in Mumbai is real. My company just signed a 5-year contract with a Navi Mumbai facility. The infrastructure quality is comparable to Singapore facilities I’ve worked with.”

5. Digital India Initiative and Policy Support

Government backing has been transformative:

- Digital India program driving data localization mandates

- Over 100 new data centers projected by 2025 due to data localization

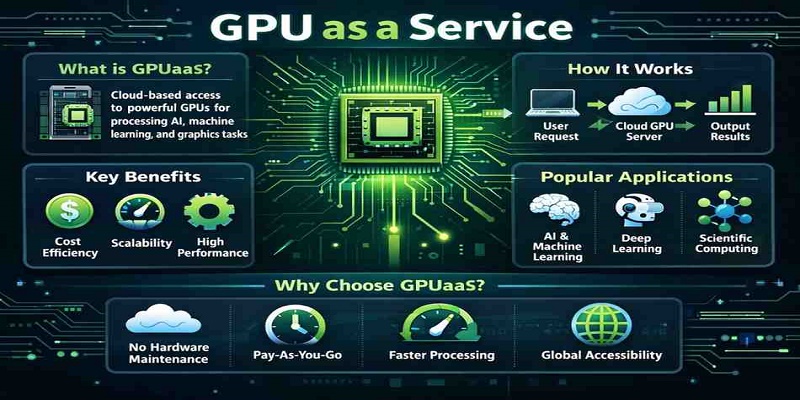

- India AI Mission: ₹10,371 crore ($1.25 billion) for 10,000 GPUs

- Government-Nvidia partnership: $1.16 billion investment in AI development

Maharashtra’s state-level initiatives include:

- Dedicated data center policy with fiscal incentives

- Collaboration with universities for Web 3.0 talent development

- Fast-track environmental clearances

- Priority power allocation

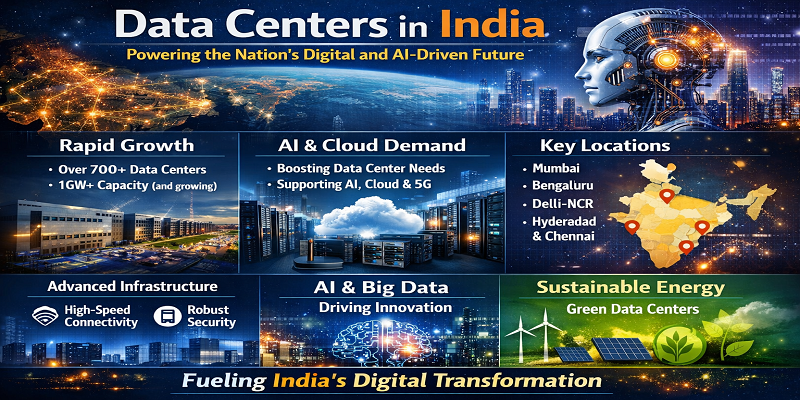

The Broader Data Center India Market Context

National Growth Trajectory

India’s data center capacity expansion is staggering:

- 2019: 590 MW operational capacity

- 2024: 1,255 MW operational capacity

- 2025 Projection: 1,600 MW operational capacity

- 2030 Target: 8 GW capacity

Key Market Metrics:

- 260+ operational data centers across India

- 121 colocation facilities operational by 2025

- Hyperscale operators increased from 5 in 2019 to 15 in 2024

- 407 MW absorption rate achieved in 2024

- 600 MW additional absorption expected in 2025

Regional Distribution

Mumbai’s dominance is clear, but other cities are emerging:

Market Share by City:

- Mumbai Metropolitan Region (MMR): 44% market share, 289 MW capacity

- Chennai: 25% of new supply in 2024

- Pune: Ranked 4th in APAC emerging markets, 112 IT MW operational, 190 IT MW pipeline

- Bengaluru: 5th in APAC emerging hubs

- Hyderabad: 6% market share

Internet Penetration and Data Consumption

The demand fundamentals are robust:

- Internet penetration: Grew from 33.4% in 2019 to 55.3% in 2025

- Total internet users: 886 million active users in 2024 (8% YoY growth)

- Rural internet users: 488 million (55% of total)

- Data consumption: 32 GB per user per month in 2025 (up from 11.5 GB in 2019)

- Monthly data consumption: Expected to surpass 25 exabytes by 2025

As a Quora user asked:

“Why is Mumbai becoming the data center capital of India when Bangalore has more tech companies?”

The answer lies in connectivity infrastructure. Mumbai’s cable landing stations and international gateway status provide unmatched low-latency access to global markets—critical for enterprise and hyperscaler operations.

Cyfuture Cloud: Powering India’s Digital Transformation

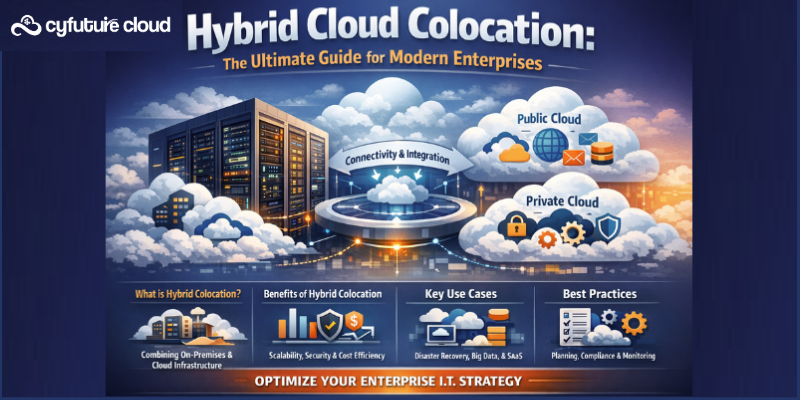

In this rapidly evolving landscape, Cyfuture Cloud has established itself as a trusted partner for enterprises seeking robust, scalable infrastructure solutions. With strategically located data centers and a commitment to 99.95% uptime SLAs, Cyfuture Cloud delivers:

- Tier III certified facilities with N+1 redundancy

- Hybrid and multi-cloud hosting solutions tailored to enterprise requirements

- 24/7 expert support from certified cloud architects

- Competitive pricing with transparent billing models

Cyfuture Cloud’s Mumbai presence enables enterprises to leverage low-latency connectivity to global markets while maintaining compliance with data localization requirements. Our infrastructure supports diverse workloads from traditional enterprise applications to cutting-edge AI/ML processing.

Challenges and Opportunities Ahead

Infrastructure Challenges

Despite impressive growth, challenges remain:

Power and Cooling:

- High power density requirements: AI racks requiring 50-150 kW vs. traditional 5-10 kW

- Sustainability concerns: Need for renewable energy integration

- Water scarcity: Cooling challenges in water-stressed regions

- Grid capacity: Strain on existing electrical infrastructure

Regulatory and Operational:

- Complex approval processes: Multiple regulatory clearances required

- Skilled talent shortage: Need for specialized data center professionals

- Land acquisition costs: Rising real estate prices in prime locations

- Cable repair capabilities: India lacks domestic vessels for submarine cable repairs

Emerging Opportunities

The future looks bright:

Edge Computing Expansion:

- Growth of tier-2 and tier-3 city deployments

- 5G rollout driving edge requirements

- IoT and real-time processing demand

Green Data Centers:

- Increasing adoption of renewable energy

- Liquid cooling technologies for high-density racks

- Circular economy principles in hardware lifecycle management

Specialized Infrastructure:

- GPU-optimized facilities for AI/ML workloads

- Quantum-ready infrastructure for future computing paradigms

- Disaster recovery and business continuity solutions

What Technology Leaders Should Know

Decision-Making Framework

When evaluating Data Center Mumbai options, consider:

- Connectivity: Proximity to submarine cable landing stations

- Power reliability: Redundant power feeds and backup systems

- Compliance: Data localization and industry-specific regulations

- Scalability: Room for future expansion as workloads grow

- Cost structure: Transparent pricing with no hidden fees

- Support capabilities: 24/7 expert assistance and SLA guarantees

Migration Strategies

For enterprises planning cloud or server colocation migrations:

- Start with non-critical workloads to validate infrastructure

- Implement hybrid models for flexibility

- Plan for data sovereignty requirements

- Leverage Indian data center proximity for latency-sensitive applications

- Consider disaster recovery across multiple availability zones

A Twitter user recently shared:

“Just migrated our e-commerce platform to a Mumbai data center. Page load times for Indian customers dropped by 40%. Should have done this years ago. #DigitalIndia”

The Road Ahead: 2025-2030 Outlook

Capacity Projections

India’s trajectory is clear:

- 2025: 2,070 MW operational capacity

- 2026: 791 MW new capacity additions

- 2030: 8 GW total capacity

- Investment required: $5.7 billion by 2026

Mumbai’s share will remain significant:

- Maintaining 42% of under-construction capacity

- Expanding to 600+ MW operational capacity by 2026

- Solidifying position as Southeast Asia connectivity hub

Technology Trends

Expect accelerated adoption of:

- AI-optimized infrastructure: Specialized cooling and power systems

- Edge computing: Distributed processing closer to users

- Sustainability initiatives: 100% renewable energy commitments

- Automation: AI-driven data center operations and management

Competitive Landscape

The market will see:

- Consolidation: Smaller players acquired by hyperscalers

- Specialization: Purpose-built facilities for specific workloads

- Regional expansion: Growth beyond traditional hubs

- International players: Continued FDI from global operators

Accelerate Your Digital Journey with Mumbai’s World-Class Infrastructure

Mumbai’s rise to 6th position globally in data center capacity under construction isn’t just a ranking—it’s a reflection of India’s digital ambitions and the city’s strategic advantages. With 335 MW under development, robust connectivity through submarine cables, and strong government support, Mumbai is positioned as a critical infrastructure hub for the next decade.

Here’s the bottom line:

For technology leaders, enterprises, and developers, the question isn’t whether to leverage India’s data center ecosystem—it’s how quickly you can deploy workloads to capitalize on this infrastructure advantage.

The numbers speak for themselves:

- 62% capacity expansion underway in Mumbai

- $24.78 billion market by 2033

- 4x internet capacity increase from submarine cables

- 800 MW AI workload commitments from cloud providers

The digital infrastructure foundation is being laid today. Organizations that establish presence now will benefit from first-mover advantages in latency, cost, and market access.

Partner with providers like Cyfuture Cloud who understand both global standards and local market dynamics. Whether you’re running traditional enterprise workloads or pioneering AI applications, Mumbai’s world-class infrastructure is ready to power your innovation.

Frequently Asked Questions (FAQs)

Why does Mumbai rank 6th globally in data center capacity under construction?

Mumbai ranks 6th globally with 335 MW under construction due to strategic location, submarine cable landing stations, government incentives, reliable power infrastructure, and massive investments from global hyperscalers like AWS, Microsoft, and Google. The city accounts for 42% of India’s total under-construction data center capacity.

What is the total data center capacity in Mumbai?

Mumbai currently has operational data center capacity that will expand by 62% once the 335 MW under-construction capacity becomes operational. The city serves as the primary hub with 44% market share in India’s data center landscape and handles 95% of India’s submarine cable traffic.

How does Data Center India market compare globally?

The India data center market was valued at $8.01 billion in 2024 and is projected to reach $24.78 billion by 2033, growing at 13.37% CAGR. India’s operational capacity reached 1,110 MW in 2024 and is expected to hit 1,600 MW by end of 2025, making it the 4th largest data center market in Asia-Pacific.

What submarine cable projects are landing in Mumbai?

Three major undersea cable projects are landing in Mumbai in 2025: 2Africa Pearls (45,000+ km, 180 Tbps), India-Asia-Express or IAX (16,000+ km, 200+ Tbps), and India-Europe-Express or IEX (9,775 km, 200+ Tbps). These will quadruple India’s internet capacity and enhance Mumbai’s position as a Southeast Asian connectivity hub.

Which companies are investing in Mumbai data centers?

Major investors include AWS ($12.7 billion), Google ($15 billion for India), Microsoft (Mumbai expansion), Princeton Digital Group ($1 billion), STT GDC ($3.2 billion), AdaniConneX ($1.44 billion), Reliance Industries ($30 billion AI campus), and Sify Technologies ($360 million).

What are the cost advantages of Mumbai data centers?

According to Turner & Townsend’s 2024 Data Center Cost Index, Mumbai’s construction cost is $6.60 per watt, which is significantly lower than competitors like Tokyo and Sydney. Combined with government incentives, tax benefits, and lower operational costs, Mumbai offers compelling economics for data center deployment.

How does Mumbai compare to Pune and Bengaluru for data centers?

Mumbai leads with 42% of India’s under-construction capacity and ranks 7th in Asia-Pacific established markets. Pune ranks 4th among APAC emerging markets with 112 IT MW operational and 190 IT MW pipeline. Bengaluru ranks 5th in APAC emerging hubs. Mumbai’s advantage lies in submarine cable infrastructure and international connectivity.

What role does AI play in Mumbai’s data center growth?

AI workloads are a primary growth driver. Cloud Service Providers have pre-committed 800 MW capacity for AI applications. Dedicated AI demand is expected between 650-800 MW from 2024-2026. Hyperscalers account for 22% of total data center stock in 2024, with investments like Reliance’s $30 billion AI campus demonstrating AI infrastructure commitment.

Is Mumbai’s data center infrastructure reliable for enterprise workloads?

Yes. Mumbai offers Tier III and Tier IV certified facilities with N+1 redundancy, 99.95%+ uptime SLAs, redundant power feeds, and 24/7 monitoring. Providers like Cyfuture Cloud ensure enterprise-grade reliability with compliance certifications including ISO 27001, PCI-DSS, and adherence to data localization requirements.

Recent Post

Send this to a friend

Server

Colocation

Server

Colocation CDN

Network

CDN

Network Linux

Cloud Hosting

Linux

Cloud Hosting Kubernetes

Kubernetes Pricing

Calculator

Pricing

Calculator

Power

Power

Utilities

Utilities VMware

Private Cloud

VMware

Private Cloud VMware

on AWS

VMware

on AWS VMware

on Azure

VMware

on Azure Service

Level Agreement

Service

Level Agreement