Table of Contents

- Searching for India’s Premier Colocation Infrastructure Partners?

- What is Colocation and Why Does It Matter?

- India’s Colocation Market: Explosive Growth Trajectory

- Top Colocation Providers in India: Market Leaders

- 1. Cyfuture Cloud – Rising Innovation Leader

- 2. STT GDC India – Market Dominance

- 3. NTT Global Data Centers – Global Excellence

- 4. CtrlS Datacenters – Tier IV Leadership

- 5. Nxtra Data Limited (Airtel) – Telecommunications Backbone

- 6. Sify Technologies – Established ICT Leader

- 7. Yotta Infrastructure (Hiranandani Group) – Hyperscale Ambition

- 8. AdaniConneX – Hyperscale Heavyweight

- 9. Equinix – Global Interconnection Leader

- 10. Digital Realty (Princeton Digital Group) – International Expansion

- Emerging Players Among Top Colocation Providers in India

- Pricing Dynamics: What to Expect from Top Colocation Providers in India

- Industry-Specific Solutions from Top Colocation Providers in India

- Future Trends: The Evolution of Top Colocation Providers in India

- Transform Your Infrastructure with India’s Leading Colocation Partner

- FAQs: Top Colocation Providers in India

- 1. What are the top colocation providers in India for enterprise clients?

- 2. How much does colocation cost in India?

- 3. What is the difference between Tier III and Tier IV data centers?

- 4. Which cities have the best colocation infrastructure in India?

- 5. How is India’s colocation market growing compared to global markets?

- 6. What compliance certifications should I look for in colocation providers?

- 7. Can I visit data center facilities before choosing a colocation provider?

- 8. What is the average uptime guarantee from top colocation providers in India?

- 9. How do I migrate my existing infrastructure to a colocation facility?

Searching for India’s Premier Colocation Infrastructure Partners?

Are you looking for the top colocation providers in India to power your digital transformation journey? India’s colocation market has emerged as one of Asia’s fastest-growing digital infrastructure ecosystems, projected to reach USD 12.24 billion by 2030 with a remarkable CAGR of 20.4%. The colocation landscape in India currently features 132 operational facilities managed by over 39 different providers across 20+ cities, offering businesses scalable, secure, and cost-effective alternatives to building proprietary data centers.

What is Colocation and Why Does It Matter?

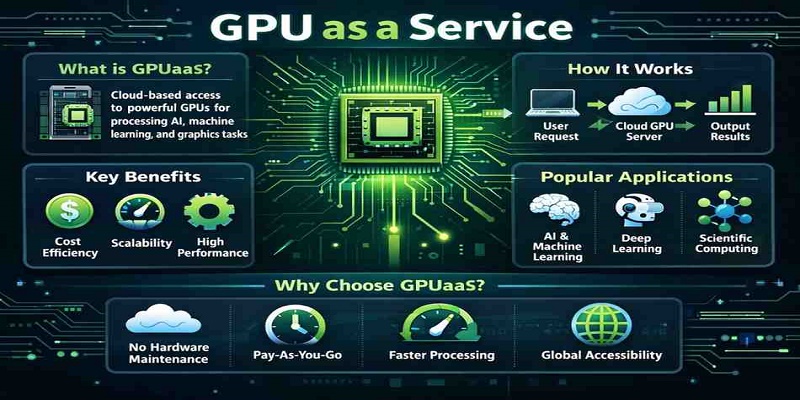

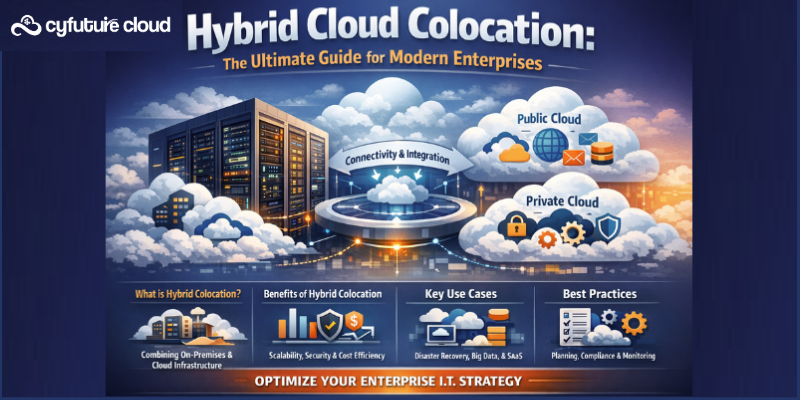

Colocation is a sophisticated hosting model where businesses rent physical space, power, cooling, and network connectivity within a professional data center facility to house their owned server infrastructure. Rather than constructing and maintaining expensive in-house data centers—which require substantial capital investment, ongoing operational expertise, and significant real estate—organizations leverage colocation to access enterprise-grade infrastructure while retaining complete control over their hardware and software configurations.

The strategic value proposition is compelling:

Here’s the reality:

Unlike public cloud services where you’re essentially renting someone else’s cloud infrastructure with limited customization, colocation provides the perfect hybrid solution. You maintain physical ownership and control of your servers while benefiting from world-class facilities engineered with redundant power systems (N+1 and 2N configurations), advanced cooling technologies, multi-layered physical security, carrier-neutral network ecosystems, and 99.99% uptime guarantees.

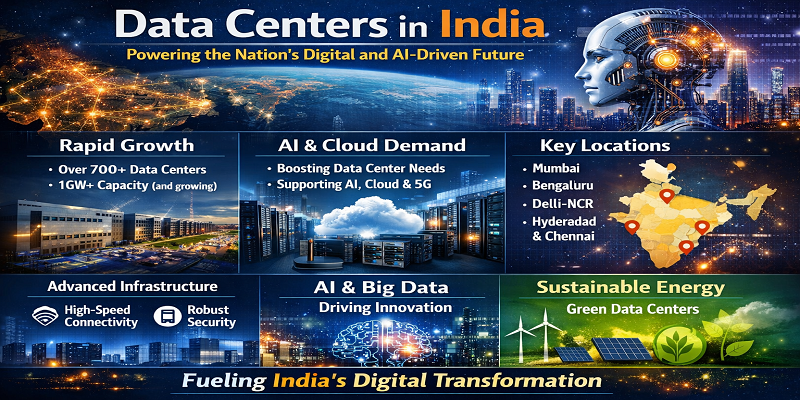

India’s Colocation Market: Explosive Growth Trajectory

The numbers tell an extraordinary story:

India’s data center colocation market reached USD 3.3 billion in 2024 and is expected to surge to USD 14.0 billion by 2033, exhibiting a growth rate of 16.34%. More aggressive projections suggest the market could hit USD 12,243.7 million by 2030, with a CAGR of 20.4% from 2025 to 2030.

What’s driving this phenomenal expansion?

Several converging factors:

- Digital India Initiatives: Government mandates pushing data localization requirements

- 5G Deployment: The establishment of 5G technologies created a boom in data transmission volume

- Cloud Adoption Surge: Hyperscalers like AWS, Microsoft, and Google committing over USD 15 billion for new Indian capacity

- AI Workload Explosion: Cloud hosting Providers pre-committed 800 MW of capacity for future AI workloads

- Cost Efficiency: Data center construction costs in Mumbai at just $6.60 per watt, comparatively lower than Tokyo or Sydney

The infrastructure numbers are equally impressive:

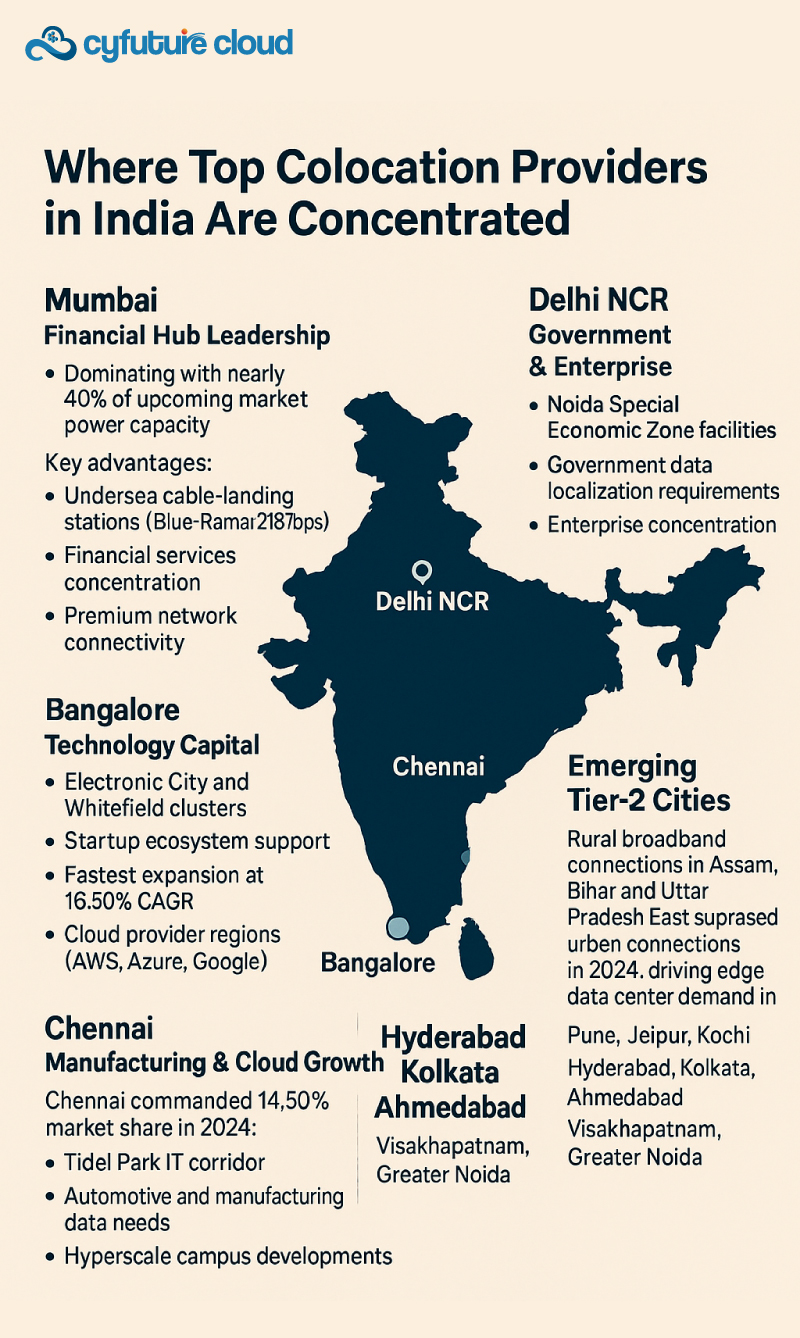

120 existing and 87 upcoming facilities across 15+ states, with operational stock reaching approximately 942 MW in the first half of 2024. Maharashtra, Karnataka, and Tamil Nadu lead development, with colocation market expected to grow at a CAGR of 25.24% from 2024 to 2030.

Top Colocation Providers in India: Market Leaders

1. Cyfuture Cloud – Rising Innovation Leader

Among the premier top colocation providers in India, Cyfuture Cloud has rapidly established itself as a trusted partner delivering cutting-edge infrastructure solutions. With strategically located Tier III, MeiTy-empaneled data centers featuring 2,000+ rack capacity across Noida, Jaipur, and Bangalore, Cyfuture Cloud specializes in customized Server colocation solutions for enterprises, startups, and Fortune 500 clients.

Distinctive Advantages:

- N+1 and 2N power redundancy: Ensuring 99.99% uptime guarantees

- Carrier-neutral connectivity: Multiple ISP options for optimized network performance

- ISO 27001, SOC 2, GDPR compliance: Meeting international security standards

- 24/7 technical support: Remote hands assistance and monitoring

- Flexible pricing models: From half-rack to full cage configurations

- Rapid deployment: Quick provisioning for urgent business needs

- Green technology integration: Energy-efficient cooling and power management

Technical Specifications:

- Multi-layered physical security with biometric authentication

- Video surveillance and intrusion detection systems

- Advanced fire suppression systems

- High-speed, low-latency network connections

- Customizable configurations: Cages, cabinets, half-racks

- Disaster recovery and business continuity solutions

2. STT GDC India – Market Dominance

STT GDC India stands as the undisputed market leader among top colocation providers in India. Operating 30 facilities across 10 major cities including Mumbai, Delhi, Chennai and Bangalore, STT GDC India manages more than 318MW of critical IT load.

Key Strengths:

- Combined IT load capacity: 400 MW

- Geographic footprint: 10 cities (Ahmedabad, Bengaluru, Chennai, Delhi, Hyderabad, Jaipur, Kolkata, Mumbai, Noida, Pune)

- Serves premier hyperscale, cloud, and enterprise clients

- Strategic partnership with Tata Communications

3. NTT Global Data Centers – Global Excellence

With an annual revenue of $3 billion, NTT DATA operates 18 facilities across Mumbai, Bangalore, Delhi NCR and Chennai, making it one of the world’s largest data center companies.

Key Strengths:

- Total IT load: 290MW across 21 facilities

- Acquired Netmagic Solutions in 2022 for expanded presence

- Carrier-neutral access to diverse networks

- Recent Noida campus with seismic dampers for AI workloads

4. CtrlS Datacenters – Tier IV Leadership

CtrlS operates 15 data centers across six Tier 1 cities with 250 MW combined installed IT load capacity, positioning itself as India’s largest Tier IV certified provider.

Key Strengths:

- Focus on high-density and energy efficiency

- Massive campuses in Mumbai, Bangalore, Kolkata, Hyderabad

- Trusted by India’s largest enterprises

- Four additional facilities under development

5. Nxtra Data Limited (Airtel) – Telecommunications Backbone

Nxtra by Airtel leverages Bharti Airtel’s telecommunications infrastructure advantage. Operating 12 data centers exceeding 200 MW capacity, Nxtra focuses on sustainable, renewable energy-powered facilities.

Key Strengths:

- First operator deploying fuel cell technology in India

- Hyperscale facilities for AI workloads

- Expansion plans across Africa

- Strong sustainability commitment with RE100 pledge

6. Sify Technologies – Established ICT Leader

Sify operates 14 data centers across India with 227+ MW IT power capacity, providing integrated colocation, cloud, and managed hosting solutions.

Key Strengths:

- Green data centers with renewable energy sources

- Robust disaster recovery capabilities

- Tailored solutions for diverse industries

- Strategic locations in major cities

7. Yotta Infrastructure (Hiranandani Group) – Hyperscale Ambition

Yotta’s flagship NM1 facility in Navi Mumbai is one of the largest data center buildings in Asia, part of a massive 50-acre campus.

Key Strengths:

- Rapid expansion with Greater Noida and Chennai parks

- One-stop-shop: colocation, cloud, and managed IT

- Focus on hyperscale capacity at unprecedented scale

- Led by industry veteran Sunil Gupta

8. AdaniConneX – Hyperscale Heavyweight

A 50:50 joint venture between Adani Group and EdgeConneX, with an ambitious goal to develop 1GW capacity within a decade.

Key Strengths:

- USD 1.44 billion financing secured

- Renewable energy focus

- Serves hyperscale clients

- Strategic locations across Chennai, Kolkata, Pune

9. Equinix – Global Interconnection Leader

Equinix brings its global expertise to India’s market. In 2025, Equinix’s CN1 facility in Chennai became operational, expanding their interconnection platform.

Key Strengths:

- Renewable energy PPAs with CleanMax

- World-class interconnection ecosystem

- Digital interconnection services

- Mumbai facilities with global reach

10. Digital Realty (Princeton Digital Group) – International Expansion

Princeton Digital Group announced a USD 1 billion investment to expand across Chennai and Mumbai with MU1 campus expansion and new CH1 campus.

Key Strengths:

- Massive capital commitment

- Focus on wholesale/hyperscale

- Three new buildings in Mumbai

- Strategic Chennai development

Emerging Players Among Top Colocation Providers in India

The competitive landscape includes several fast-growing providers:

- Iron Mountain: Post-acquisition of Web Werks, operating facilities across Mumbai, Pune, Delhi NCR

- Tata Communications: 13 premier data centers with global network integration

- Bridge Data Centres: Rapid expansion in tier-2 cities

- Pi Datacenters: Focus on edge computing solutions

- ESDS Data Center: Cloud integration specialist

- Lumina CloudInfra: New entrant with aggressive growth plans

- CapitaLand: Singapore-based investor expanding footprint

Pricing Dynamics: What to Expect from Top Colocation Providers in India

Colocation pricing in India varies significantly based on location, specifications, and service levels:

Rack Space Pricing

- Mumbai: ₹18,000 – ₹30,000 per rack unit monthly

- Bangalore: ₹15,000 – ₹25,000 per rack unit monthly

- Chennai/Delhi: ₹12,000 – ₹22,000 per rack unit monthly

- Tier-2 cities: ₹8,000 – ₹15,000 per rack unit monthly

Power-Based Pricing

- Per kW/month: ₹8,000 – ₹15,000 depending on city and redundancy level

- Typically more economical for high-density deployments

Value-Added Services

- Bandwidth: ₹500 – ₹2,000 per Mbps

- Remote hands: ₹2,000 – ₹5,000 per hour

- Managed services: Custom pricing based on SLA requirements

Industry-Specific Solutions from Top Colocation Providers in India

BFSI (Banking, Financial Services, Insurance)

BFSI is set to log the fastest growth at 18.20% CAGR to 2030.

Requirements:

- RBI compliance and data localization

- Disaster recovery with RPO/RTO guarantees

- PCI-DSS certification

- Ultra-low latency trading platforms

IT & Telecom

IT and telecom commanded 46.50% share in 2024.

Use cases:

- Cloud service provider infrastructure

- Content delivery networks (CDN)

- Telecom switching and routing

- 5G edge computing nodes

E-commerce & Retail

- Real-time inventory management

- Customer data analytics

- Payment gateway hosting

- Seasonal scalability for festivals

Healthcare

- HIPAA/ABDM compliance

- Electronic health records (EHR)

- Telemedicine platforms

- Medical imaging storage

Media & Entertainment

- OTT streaming infrastructure

- Content rendering farms

- Digital asset management

- Live event broadcasting

Future Trends: The Evolution of Top Colocation Providers in India

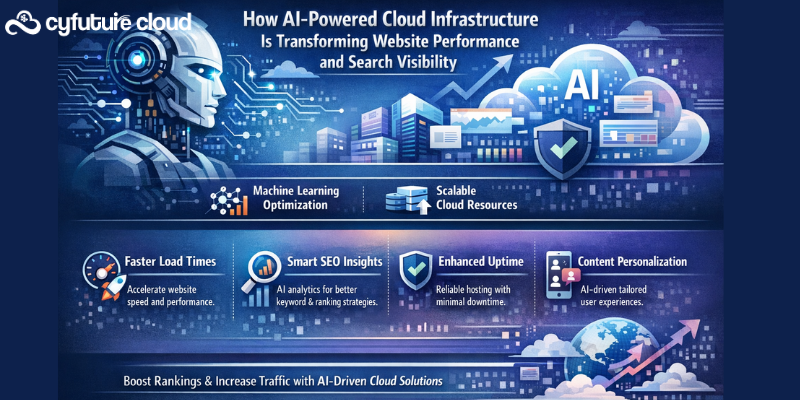

AI & Machine Learning Workloads

AI applications requiring 650-800 MW dedicated demand from 2024 to 2026 drive transformation:

- High-density racks: 50-120 kW per rack

- Liquid cooling: Direct-to-chip and immersion technologies

- GPU clusters: Specialized power and networking

- Low-latency interconnects: InfiniBand and RoCE

Edge Computing Expansion

OTT subscriptions driving latency-sensitive caches into tier-2 cities like Pune, Jaipur and Kochi:

- Micro data centers: Compact, modular deployments

- 5G integration: Mobile edge computing (MEC)

- IoT gateways: Processing at data generation points

- Content caching: Distributed CDN nodes

Hybrid & Multi-Cloud Integration

- Cloud on-ramps: Direct connections to hyperscalers

- Hybrid architectures: Seamless workload portability

- Multi-cloud orchestration: Unified management platforms

- SD-WAN integration: Optimized connectivity

Hyperscale Dominance

Hyperscale/self-built deployments projected at 21.50% CAGR through 2030:

- Build-to-suit: Custom campuses for cloud hosting providers

- Wholesale colocation: Megawatt-scale commitments

- On-site renewables: Solar farms and wind integration

- Campus connectivity: Private fiber networks

Regulatory Evolution

- Data Protection Bill: Enhanced privacy requirements

- Data localization: Sector-specific storage mandates

- Infrastructure status: Accelerated depreciation benefits

- Single-window clearances: Streamlined project approvals

Transform Your Infrastructure with India’s Leading Colocation Partner

With 120+ active data centers and 87 more underway, India’s colocation landscape is accelerating a nationwide digital transformation. From first-rack startups to multi-megawatt enterprise deployments, colocation eliminates massive ₹50–200 crore build costs, ensures 99.99% uptime, enables seamless scaling, compliance readiness, and carrier-neutral connectivity.

Among the top colocation providers, Cyfuture Cloud delivers Tier III, MeiTy-empaneled infrastructure with N+1 / 2N redundancy, 2,000+ rack capacity, and 24/7 expert support built for mission-critical workloads.

FAQs: Top Colocation Providers in India

1. What are the top colocation providers in India for enterprise clients?

The leading top colocation providers in India include STT GDC India (400 MW, 30 facilities), NTT Global Data Centers (290MW, 21 facilities), CtrlS Datacenters (250 MW, 15 facilities), Nxtra by Airtel (200+ MW), and Cyfuture Cloud (2,000+ racks, Tier III MeiTy-empaneled). Each offers distinct advantages based on geographic footprint, pricing models, and specialized services.

2. How much does colocation cost in India?

Colocation pricing varies by location and specifications. In Mumbai, expect ₹18,000-₹30,000 per rack unit monthly; Bangalore: ₹15,000-₹25,000; tier-2 cities: ₹8,000-₹15,000. Power-based pricing ranges ₹8,000-₹15,000 per kW/month. Cyfuture Cloud offers competitive, transparent pricing with flexible configurations.

3. What is the difference between Tier III and Tier IV data centers?

Tier III facilities provide 99.982% availability (1.6 hours downtime/year) with N+1 redundancy and concurrent maintenance capability. Tier IV offers 99.995% availability (26.3 minutes downtime/year) with 2N+1 redundancy and fault-tolerant infrastructure. Tier 3 held 49.61% market share in 2024, while Tier 4 grows at 20.55% CAGR.

4. Which cities have the best colocation infrastructure in India?

Mumbai leads with premium connectivity and undersea cable access. Bangalore dominates technology sectors with fastest growth at 16.50% CAGR. Chennai and Delhi NCR offer strong enterprise concentration. Tier-2 cities like Pune, Jaipur, and Hyderabad provide cost-effective alternatives with growing infrastructure.

5. How is India’s colocation market growing compared to global markets?

India’s colocation market is expanding from USD 3.3 billion (2024) to USD 14.0 billion (2033) at 16.34% CAGR, significantly outpacing global averages. India accounted for 5.9% of the global data center colocation market in 2024, with rapid growth driven by digital transformation and government initiatives.

6. What compliance certifications should I look for in colocation providers?

Essential certifications include ISO 27001 (information security management), SOC 2 Type II (operational controls), PCI-DSS (payment processing), GDPR compliance, and industry-specific certifications like HIPAA for healthcare. MeiTy empanelment indicates government compliance. Cyfuture Cloud maintains comprehensive certification coverage.

7. Can I visit data center facilities before choosing a colocation provider?

Yes, reputable top colocation providers in India offer facility tours. Cyfuture Cloud encourages prospective clients to visit their ultra-modern Tier III data centers in Noida, Jaipur, and Bangalore to inspect infrastructure, security measures, and operational excellence firsthand before making decisions.

8. What is the average uptime guarantee from top colocation providers in India?

Tier III facilities guarantee 99.982% uptime (1.6 hours downtime annually), while Tier IV facilities offer 99.995% (26.3 minutes annually). Leading providers like Cyfuture Cloud provide 99.99% uptime guarantees backed by SLA credits for any violations.

9. How do I migrate my existing infrastructure to a colocation facility?

Professional colocation providers offer comprehensive migration services: assessment of current infrastructure, detailed migration planning, coordination with your IT team, physical relocation assistance, network configuration, testing protocols, and cutover execution. Cyfuture Cloud’s expert team ensures zero-disruption migrations with detailed runbooks.

Recent Post

Send this to a friend

Server

Colocation

Server

Colocation CDN

Network

CDN

Network Linux

Cloud Hosting

Linux

Cloud Hosting Kubernetes

Kubernetes Pricing

Calculator

Pricing

Calculator

Power

Power

Utilities

Utilities VMware

Private Cloud

VMware

Private Cloud VMware

on AWS

VMware

on AWS VMware

on Azure

VMware

on Azure Service

Level Agreement

Service

Level Agreement