Table of Contents

- Searching for the Best Colocation Providers in the United States?

- What is Colocation and Why It Matters for Your Business

- Understanding the US Colocation Market Landscape

- Top Colocation Providers in US: Industry Leaders Shaping Digital Infrastructure

- 1. Cyfuture Cloud – Emerging Leader in Managed Colocation

- 2. Equinix – Global Interconnection Leader

- 3. Digital Realty – Hyperscale Infrastructure Specialist

- 4. NTT Global Data Centers – Enterprise-Scale Colocation

- 5. CyrusOne – High-Density Flexible Solutions

- 6. CoreSite (American Tower) – Network-Dense Metropolitan Facilities

- 7. QTS Realty Trust – Data Center Solutions Provider

- 8. Vantage Data Centers – Hyperscale Campus Development

- 9. Flexential – Managed Colocation Specialist

- 10. Iron Mountain Data Centers – Security-Focused Infrastructure

- Critical Factors When Evaluating Top Colocation Providers in US Markets

- Industry Statistics: The State of US Colocation in 2025-2026

- Future Trends Shaping Top Colocation Providers in US Markets

- Transform Your Infrastructure Strategy with Premier Colocation Solutions

- Frequently Asked Questions (FAQs)

- What are the key advantages of using colocation services versus building a private data center?

- How do I choose between retail colocation and wholesale colocation?

- What power density should I plan for when evaluating top colocation providers in US facilities?

- How important is geographic location when selecting colocation providers?

- What security certifications should I require from colocation providers?

- How do top colocation providers in US markets support hybrid cloud architectures?

- What does “carrier-neutral” mean and why is it important?

- How are colocation providers addressing sustainability and environmental impact?

- What SLAs should I expect from enterprise-grade colocation providers?

Searching for the Best Colocation Providers in the United States?

Colocation services let enterprises rent space in third-party data centers to house their servers and IT equipment—accessing enterprise-grade power, cooling, security, and connectivity without the capital burden of building proprietary facilities.

Here’s what matters:

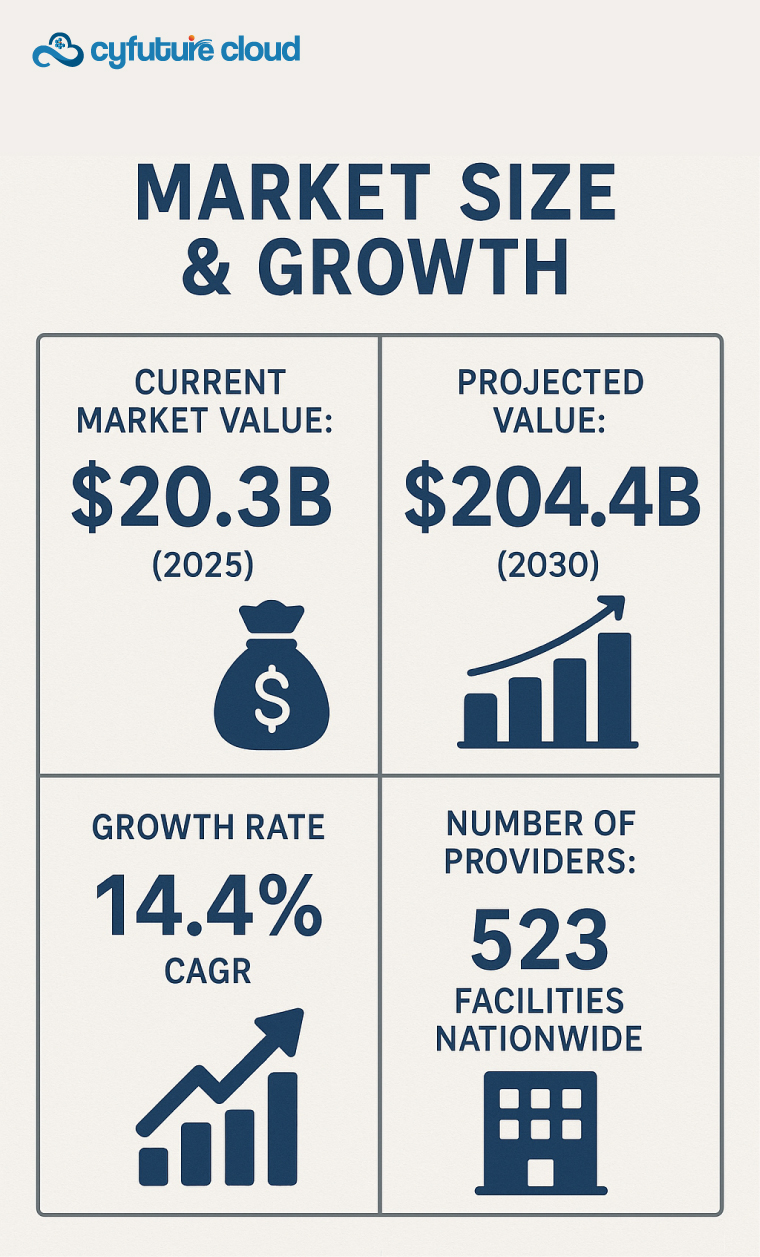

The US colocation market hit $20.3 billion in 2025 and is projected to surge to $204.4 billion by 2030—a staggering 14.4% CAGR. Businesses across sectors now recognize colocation as mission-critical infrastructure.

What is Colocation and Why It Matters for Your Business

Colocation services enable organizations to deploy their IT assets in professionally managed data centers without shouldering the operational complexity of facility management. Think of it as having your own dedicated infrastructure within a shared, carrier-neutral environment where multiple enterprises coexist—each maintaining complete control over their hardware while benefiting from institutional-grade facilities.

The value proposition is compelling:

- Cost Optimization: Eliminate capital expenditures on real estate, power systems, cooling cloud infrastructure, and physical security

- Reliability Engineering: Access redundant power feeds, backup generators, advanced HVAC systems, and 99.99% uptime guarantees

- Strategic Scalability: Expand infrastructure capacity without lengthy construction timelines or massive upfront investments

- Carrier-Neutral Connectivity: Connect to multiple ISPs, cloud hosting providers, and peering exchanges for optimized network performance

Understanding the US Colocation Market Landscape

The American colocation ecosystem dominates global infrastructure, accounting for over 40% of worldwide colocation revenue. The explosive growth trajectory is fueled by several converging forces:

Artificial Intelligence and High-Performance Computing: The proliferation of AI workloads demands specialized infrastructure. Liquid-cooled environments supporting 40 to 60 kW per rack have become differentiators as enterprises deploy compute-intensive machine learning models.

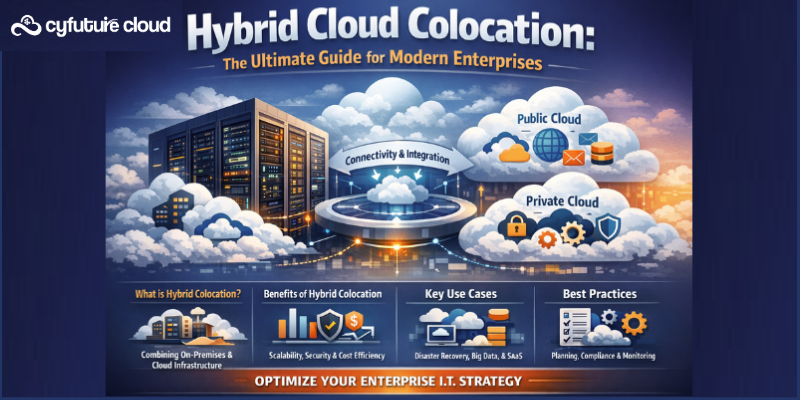

Hybrid Cloud colocation Architectures: Organizations increasingly adopt hybrid IT strategies, integrating on-premises infrastructure with public cloud services. This requires low-latency Layer-2 connectivity spanning colocation centers and cloud regions.

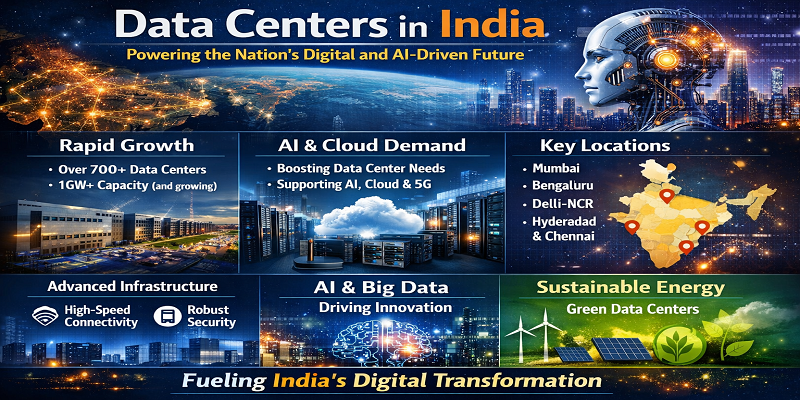

Data Sovereignty Compliance: Evolving regulations in Europe, India, and Australia are accelerating investment in jurisdiction-specific facilities, with data center operators expected to add over 23.2 GW of installed power capacity between 2025 and 2030.

Edge Computing Revolution: Edge data centers are projected to account for 25% of colocation revenue by 2026, driven by IoT deployments, autonomous systems, and real-time processing requirements.

Top Colocation Providers in US: Industry Leaders Shaping Digital Infrastructure

1. Cyfuture Cloud – Emerging Leader in Managed Colocation

Cyfuture Cloud has established itself among the premier colocation providers serving enterprise clients with customized infrastructure solutions. The company distinguishes itself through:

- Tier III Certified Data Center in India: Guaranteeing 99.995% uptime with N+1 redundancy for power and cooling systems

- AI-Optimized Infrastructure: High-density racks supporting up to 42kW per rack with advanced liquid cooling capabilities

- Comprehensive Security: Multi-layered protection including biometric access controls, 24/7 surveillance, and ISO 27001, SOC 2, PCI-DSS compliance

- Flexible Scaling Options: From single 2U server slots to private cages and wholesale suite deployments

- Managed Services Integration: Full-stack support including 24/7 monitoring, remote hands, and infrastructure management

What sets Cyfuture Cloud apart is its hybrid approach—seamlessly integrating colocation with cloud services to create optimized environments for diverse workloads. With over two decades of expertise in digital infrastructure, the company serves clients across BFSI, healthcare, e-commerce, and technology sectors with tailored solutions addressing unique compliance and performance requirements.

2. Equinix – Global Interconnection Leader

Equinix, Inc. is the biggest company operating in the Colocation Facilities industry in the United States. Operating over 260 IBX data centers across 33 countries, Equinix dominates through its interconnection-focused strategy.

Key Differentiators:

- Software-defined interconnection fabric (ECX Fabric) enabling seamless multi-cloud connectivity

- Access to over 3,000 cloud and network providers within carrier-neutral ecosystems

- 96% renewable energy usage across global portfolio

- AI-powered monitoring and high-density liquid cooling for next-generation workloads

Recent Expansion: Equinix inaugurated the PA13x colocation data center in Meudon, France in February 2025, designed specifically for AI workloads with heat recovery systems and photovoltaic panels.

3. Digital Realty – Hyperscale Infrastructure Specialist

As the second-largest player among top colocation providers in US markets, Digital Realty operates a massive global footprint serving hyperscale cloud providers and enterprise clients.

Strategic Capabilities:

- Hundreds of data centers spanning North America, Europe, Asia-Pacific, and Latin America

- Wholesale-focused offerings optimized for megawatt-scale deployments

- PlatformDIGITAL® ecosystem facilitating hybrid IT architectures

- Service Exchange enabling direct connections to cloud service providers

4. NTT Global Data Centers – Enterprise-Scale Colocation

NTT GDC combines worldwide reach with deep local market expertise, operating strategically positioned campuses across the US.

Competitive Advantages:

- Plans to launch a data center REIT seeded with six facilities across US, Europe, and Singapore, totaling over 41,000 sqm and approximately 80MW (announced May 2025)

- Advanced security frameworks meeting strict regulatory requirements

- Green technology adoption targeting sustainability benchmarks

- Integration with NTT’s global telecommunications network

5. CyrusOne – High-Density Flexible Solutions

Operating over 50 mission-critical facilities globally, CyrusOne specializes in hyperscale, enterprise, and hybrid cloud colocation deployments.

Notable Features:

- Flexible infrastructure supporting high-density AI and GPU workloads

- Custom-built environments tailored to specific technical requirements

- 190-megawatt agreement with Calpine Corporation to power new data center in Bosque County, Texas (operational Q4 2026)

- Sustainability commitments with renewable energy sourcing

6. CoreSite (American Tower) – Network-Dense Metropolitan Facilities

CoreSite operates 28 data centers across 8 U.S. metro areas, specializing in high-connectivity campuses in major markets including Los Angeles, Denver, Chicago, and Silicon Valley.

Key Attributes:

- Network-dense facilities with direct connections to leading cloud platforms

- Low-latency access to major internet exchanges

- Attractive pricing for finance, content, and SaaS providers

- Integration with American Tower’s edge and interconnection strategy

7. QTS Realty Trust – Data Center Solutions Provider

QTS delivers comprehensive colocation and managed cloud services across strategically located facilities.

Distinguishing Characteristics:

- Accounting for roughly 20–25% of global market share alongside other top providers

- Hybrid solutions combining colocation with managed IT services

- Recent expansion in Phoenix, Arizona addressing growing southwestern demand

- Custom critical environments for unique enterprise requirements

8. Vantage Data Centers – Hyperscale Campus Development

Vantage specializes in massive hyperscale campus builds, typically exceeding 100MW capacity.

Strategic Positioning:

- 35 campuses across five continents with planned and existing global capacity exceeding 2.6 GW

- Focus on wholesale colocation for cloud providers and large enterprises

- Aggressive international expansion through strategic acquisitions

- Purpose-built infrastructure for AI and high-performance computing

9. Flexential – Managed Colocation Specialist

Flexential differentiates through comprehensive managed services integrated with colocation offerings.

Service Portfolio:

- Disaster recovery and business continuity solutions

- Cloud backup and migration services

- Compliance support for HIPAA, PCI, SOC 2, and other frameworks

- Tiered service models scaling with business requirements

- Unified platform for infrastructure monitoring and support ticketing

10. Iron Mountain Data Centers – Security-Focused Infrastructure

Leveraging decades of experience in secure record storage, Iron Mountain brings unique security expertise to colocation.

Security Emphasis:

- Underground and heavily fortified facilities

- Military-grade physical security protocols

- Compliance with HIPAA, PCI, ISO, and FISMA standards

- Ideal for healthcare, government, and financial services sectors requiring maximum data protection

Critical Factors When Evaluating Top Colocation Providers in US Markets

Geographic Distribution and Market Presence

Location strategy directly impacts latency, disaster recovery, and business continuity. The largest US data center markets include:

- Northern Virginia (Data Center Alley): Nearly 2.6 Gigawatts of capacity representing almost 35% of global data center capacity

- Dallas-Fort Worth: Second largest market at 653 Megawatts with power costs under 6 cents per kilowatt hour

- Silicon Valley: Premium location for tech companies despite being the most expensive North American market

- Phoenix: Fourth largest market with renewable energy abundance and low natural disaster risk

- Chicago: Strategic crossroads location serving both coasts with lowest data center pricing among major global markets

Power Density and Cooling Infrastructure

Modern workloads demand sophisticated power and thermal management. When comparing top colocation providers in US facilities:

- Standard Density: 5-8 kW per rack for traditional IT workloads

- High Density: 15-25 kW per rack for virtualized and cloud environments

- Ultra-High Density: 40-60 kW per rack for AI, HPC, and GPU-intensive applications requiring liquid cooling

Liquid cooling is becoming a significant trend that major colocation operators like Equinix, Digital Realty, Aligned Data Centers, and CyrusOne are implementing to support next-generation computing requirements.

Connectivity Ecosystems

Carrier-neutral facilities offering diverse connectivity options provide:

- Direct connections to multiple Tier 1 ISPs

- On-ramps to major cloud platforms (AWS, Azure, Google Cloud, Oracle Cloud)

- Access to internet exchanges for optimized peering

- Private interconnection services for low-latency data transfer

Compliance and Security Certifications

Regulated industries require robust compliance frameworks:

- Financial Services: PCI-DSS, SOC 2 Type II, ISO 27001

- Healthcare: HIPAA, HITECH

- Government: FedRAMP, FISMA, ITAR

- International: GDPR compliance for organizations with EU data residency requirements

Sustainability and Environmental Responsibility

By 2026, it is estimated that 35% of colocation facilities will be powered by renewable energy sources. Leading providers invest in:

- Renewable energy procurement and power purchase agreements

- Advanced cooling technologies reducing Power Usage Effectiveness (PUE)

- LEED certification and green building standards

- Carbon offset programs and net-zero commitments

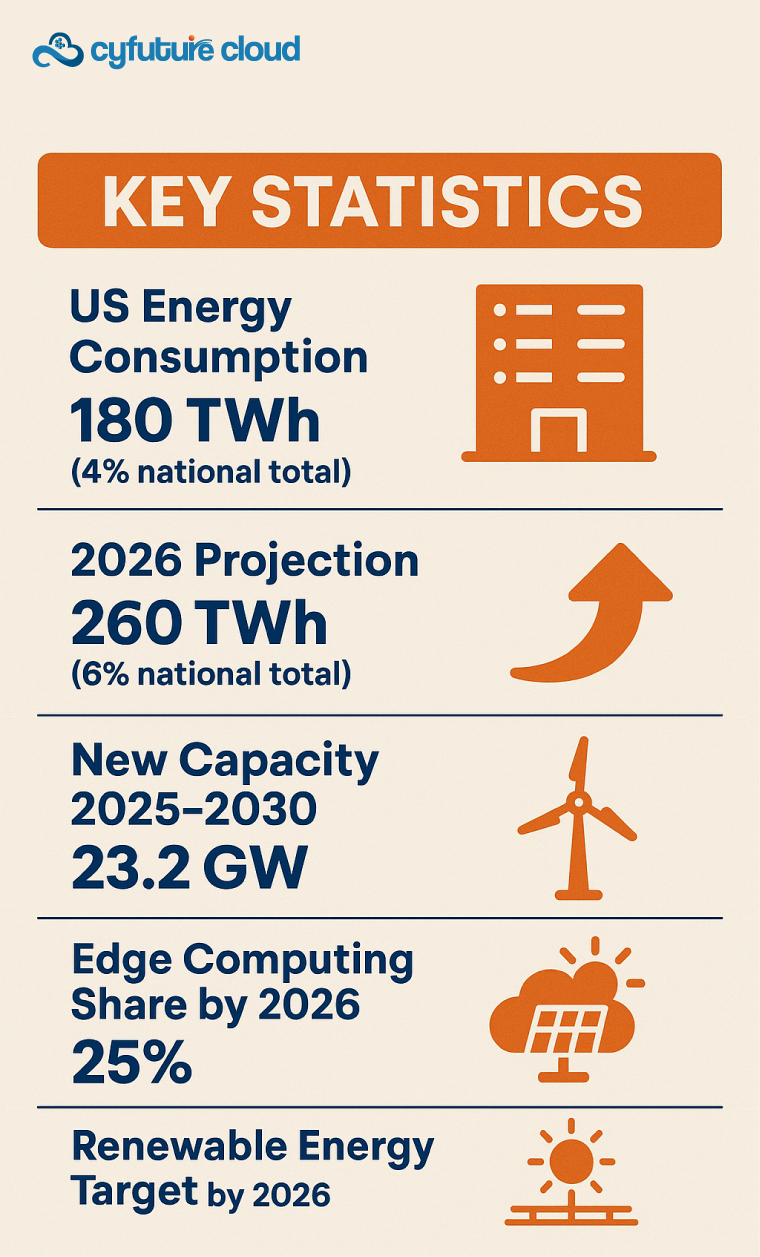

Industry Statistics: The State of US Colocation in 2025-2026

The data paints a clear picture of market dynamics:

Market Size and Growth:

- Global data center colocation market valued at USD 64.6 billion in 2025, expected to reach USD 155.9 billion by 2034

- Market growing at CAGR of 13.22% from 2026 to 2032

- US colocation facilities industry has grown at CAGR of 7.5% between 2019 and 2024

Market Composition:

- 523 businesses in the Colocation Facilities industry in the United States

- 2,226 businesses in the Data Center Colocation Services industry

- Retail colocation segment holds dominant market position at 54.6% share

- Wholesale colocation experiencing fastest growth due to hyperscale demand

Energy and Capacity:

- US data centers consumed roughly 180 TWh in 2024, representing more than 4% of total US electricity

- Projected to rise to about 260 TWh by 2026, approximately 6% of national demand

- Southeastern US expected to lead with over 8.9 GW of new capacity, followed by Southwestern US with 6.8 GW

Regional Distribution:

- North America maintains largest regional market share

- Asia-Pacific emerging as fastest-growing region with 15-19% CAGR

- Northern Virginia hosts almost 2.6 Gigawatts of capacity

Future Trends Shaping Top Colocation Providers in US Markets

Edge Computing Proliferation

Distributed edge deployments require localized data processing closer to end users. Edge data centers projected to account for 25% of colocation revenue by 2026, driving demand for regional facilities supporting latency-sensitive applications.

AI Infrastructure Specialization

Artificial intelligence workloads impose unprecedented demands on power density, cooling capacity, and GPU clustering. Top colocation providers in US markets are investing billions in AI-ready infrastructure with specialized power distribution, liquid cooling systems, and high-speed networking fabrics.

Hybrid and Multi-Cloud Integration

Organizations increasingly deploy workloads across multiple environments. Leading providers offer:

- Cloud exchange platforms for direct, private connectivity

- Hybrid infrastructure supporting seamless workload portability

- Multi-cloud networking and security services

- Edge-to-core integration for distributed architectures

Sustainability Mandates

Environmental responsibility is transitioning from differentiator to requirement. Providers pursuing:

- Renewable energy commitments targeting 100% clean power

- Advanced cooling technologies (liquid cooling, free cooling, adiabatic systems)

- Circular economy principles for hardware lifecycle management

- Carbon reporting and emissions reduction targets

Transform Your Infrastructure Strategy with Premier Colocation Solutions

The landscape of top colocation providers in US markets offers unprecedented choice—from Cyfuture Cloud’s managed excellence to Equinix’s interconnection leadership and Digital Realty’s hyperscale capabilities. Select partners aligned with your technical requirements, compliance mandates, and business objectives.

Evaluate thoroughly: Assess power density and cooling needs. Verify compliance certifications. Compare pricing models. Consider geographic distribution for redundancy. Prioritize sustainability commitments.

The US colocation market’s growth from $17.1 billion in 2025 toward $204.4 billion by 2030 reflects fundamental shifts in enterprise infrastructure. Whether supporting AI workloads, enabling hybrid cloud strategies, or meeting regulatory requirements, the right colocation provider is your strategic imperative.

The question isn’t whether colocation belongs in your infrastructure roadmap—it’s which of the top colocation providers in US markets best positions your organization for accelerated innovation and sustainable growth.

Frequently Asked Questions (FAQs)

What are the key advantages of using colocation services versus building a private data center?

Colocation eliminates massive capital expenditures on facilities, power infrastructure, cooling systems, and security while providing immediate access to enterprise-grade infrastructure. Organizations avoid 18-24 month construction timelines and benefit from carrier-neutral connectivity, professional facility management, and economies of scale that reduce operational costs by 40-60% compared to private data center operations.

How do I choose between retail colocation and wholesale colocation?

Retail colocation suits organizations needing fractional space (cabinets, cages) with flexible terms and managed services. It’s ideal for startups, SMBs, and enterprises with moderate footprints. Wholesale colocation targets organizations requiring megawatt-scale deployments (multiple MW) with long-term commitments (5-10+ years), offering lower per-unit costs but requiring greater infrastructure management responsibility.

What power density should I plan for when evaluating top colocation providers in US facilities?

Standard IT workloads typically require 5-8 kW per rack. Cloud and virtualized environments need 15-25 kW per rack. AI, machine learning, and high-performance computing applications demand 40-60+ kW per rack, necessitating liquid cooling solutions. Always plan for 20-30% growth headroom in power requirements.

How important is geographic location when selecting colocation providers?

Location critically impacts latency (proximity to users), disaster recovery (geographic diversity for redundancy), compliance (data sovereignty requirements), and operational costs (power prices vary significantly by region). Organizations should balance primary market presence with secondary site locations for business continuity.

What security certifications should I require from colocation providers?

Essential certifications vary by industry: SOC 2 Type II and ISO 27001 for general security compliance, PCI-DSS for payment processing, HIPAA for healthcare, FedRAMP/FISMA for government, and GDPR compliance for organizations handling EU citizen data. Verify annual audits and continuous compliance monitoring.

How do top colocation providers in US markets support hybrid cloud architectures?

Leading providers offer cloud exchange platforms (Equinix Cloud Exchange, Digital Realty ServiceExchange) enabling direct, private connections to AWS, Azure, Google Cloud, and other platforms. These services provide low-latency Layer-2 connectivity, reduced data egress costs, and seamless workload portability between on-premises and cloud environments.

What does “carrier-neutral” mean and why is it important?

Carrier-neutral facilities allow customers to choose from multiple telecommunications providers and internet service providers without restrictions. This ensures competitive pricing, redundant connectivity options, diverse routing paths for reliability, and flexibility to change providers without facility migration.

How are colocation providers addressing sustainability and environmental impact?

Top providers invest in renewable energy procurement (wind, solar), advanced cooling technologies reducing PUE to 1.2-1.3, LEED-certified facilities, waste heat recovery systems, and carbon offset programs. By 2026, 35% of facilities are expected to run on renewable energy. Organizations should request sustainability reports and emissions data during evaluation.

What SLAs should I expect from enterprise-grade colocation providers?

Tier III facilities guarantee 99.982% uptime (1.6 hours downtime annually), while Tier IV facilities promise 99.995% uptime (26.3 minutes annually). Leading providers offer financial credits for SLA breaches, typically 10-25% of monthly fees per incident. Review SLA terms for power availability, network uptime, cooling performance, and physical security commitments.

Recent Post

Send this to a friend

Server

Colocation

Server

Colocation CDN

Network

CDN

Network Linux

Cloud Hosting

Linux

Cloud Hosting Kubernetes

Kubernetes Pricing

Calculator

Pricing

Calculator

Power

Power

Utilities

Utilities VMware

Private Cloud

VMware

Private Cloud VMware

on AWS

VMware

on AWS VMware

on Azure

VMware

on Azure Service

Level Agreement

Service

Level Agreement