Table of Contents

“The Data Center India industry has attracted huge investments after the infrastructure status. This is in line with the Government’s vision of making India a Data Center hub.”

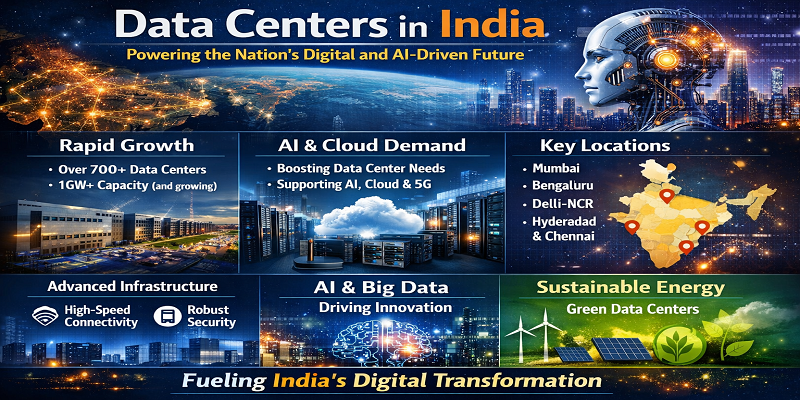

Due to digitalization efforts and support from the government, the market for 5G network Data Centers in India is growing very quickly. By 2029, the Data Center India Market will be worth $2.84 billion, growing at a pace of 10.8% year between 2022 and 2029, predicts Maximise Research.

|

Do You Know? Due to digitalization efforts and government support, the market for 5G network Data Centers in India is growing very quickly. By 2029, the Data Center market in India will be worth $2.84 billion, growing at a pace of 10.8% between 2022 and 2029, predicts Maximise Research. |

The industry is getting a lot of investments, over $3.7 billion from 2021 to 2023, due to a strong infrastructure to support digital technologies and store data, as well as a boom in the use of cutting-edge technologies like artificial intelligence and machine learning. Data centers in India are expected to grow dramatically over the next years with an estimated $5 billion in investments, with a capacity that will reach 1,700 MW by 2025. This is already happening, as seen by the growth of capacity from 540 MW in 2019 to over 800 MW in 2022. Data Center providers have more than 3,000 MW of capacity planned for the future.

A recent report by Google, Bain, and Temasek predicts that the Indian Internet economy will reach 1 trillion by 2030. The government knows this enormous potential and has taken proactive steps and policies to support the Data Center industry.

The Indian government has granted cloud storage (Data Center) and energy storage systems special status in the budget for 2022–2023, making it more straightforward for them to get permissions and financial backing. The Indian government is aware that the country is transitioning from an emerging to a developed market economy and that digital technology is essential to this process.

India has experienced a tremendous increase in digital commerce, entertainment, and social media usage. With over a billion mobile phones and over 700 million internet connections, India currently consumes the most mobile data globally, and this is rising.

After the lockout, the average daily data increased by 14% to 308 Petabytes. Smartphone users also spent 16% more time on their devices than before the COVID-19 pandemic. Online education and work-from-home arrangements contributed to this significant increase in data usage. The government understands the importance of Data Centers in driving digitalization and wants to take advantage of the favorable conditions to position India as a global hub for Data Centers, promoting local businesses and realizing the Prime Minister’s vision of Make in India.

What are the government policies and market players in the data center industry? Let’s discuss this in detail!

Favourable Regulatory Policies for Data Centers in India

The Ministry of Electronics and Information Technology updated its data centre strategy in 2020 with the intention of making India a hub for data centres throughout the globe. The goal was to create an environment for the industry that was encouraging, demanding, and sustainable. The policy had key areas that focused on providing uninterrupted, clean, and affordable electricity for data centres. It also aimed to improve connectivity and declare data centres as essential services. Furthermore, the policy recognized data centres as a separate category under the National Building Code. The draft policy suggested the establishment of special areas called Data Centre Economic Zones to promote the development of local technology, research, and capacity building.

States like Maharashtra, Telangana, Karnataka, and Uttar Pradesh provide benefits to data centres, such as exemptions on stamp duty and electricity charges, subsidies on power, and discounts on land prices. Piyush Somani, the Managing Director of ESDS Software Solutions, mentioned that the government has implemented policies to support the growth of data centres in India. These policies include requirements to keep data within the country, simplified regulations, improved digital infrastructure, incentives for adopting renewable energy, and initiatives for skill development. These policies aim to ensure data security, improve business operations, enhance connectivity, promote sustainability, and cultivate a skilled workforce, which leads to the expansion of the data centre industry in India.

The government has consistently supported data centres over the years. The National Digital Communications Policy 2018 aims to attract investments worth $100 billion and create four million direct and indirect jobs in the digital communications sector, which includes data centres. The Government’s Digital India strategy has generated a large amount of data, and many of these data need to be stored within the country. For instance, the Data Protection Bill and a recent mandate by the Computer Emergency Response Team (CERT-IN) require companies to store consumer data in India for at least five years.

The Growth Centers in India

The friendly policies and regulations are expected to attract investments of up to Rs 3 lakh crore in the short term. The data centre market has grown significantly, with 89 MW of capacity absorbed in the first half of 2022, compared to 47 MW in H1 2021. Mumbai has been the main driver of demand, accounting for about 65% of the total installed capacity. This is because Mumbai has landing stations along its coast, making it an ideal location. Pune and Chennai also have a significant presence in the data centre market, comprising 10% and 9% of the installed capacity respectively. Pune is attractive to hyper-scale companies, while Chennai benefits from its strategic location and favourable infrastructure.

Power supply is crucial for data centres, requiring stable and redundant infrastructure such as backup generators and reliable electrical connections. Water supply is also important for cooling systems and other operational needs. Data centre providers consider locations with access to sustainable water sources and invest in efficient water management practices. Proximity to landing stations and financial hubs are important factors in choosing data centre locations.

Security measures, both physical and digital, are implemented to protect customer data. High-speed and low-latency network connectivity is provided through multiple carriers and peering relationships. Compliance with industry standards and regulatory requirements is essential, along with monitoring and management systems for performance, capacity, and security.

Market Players and Dynamics

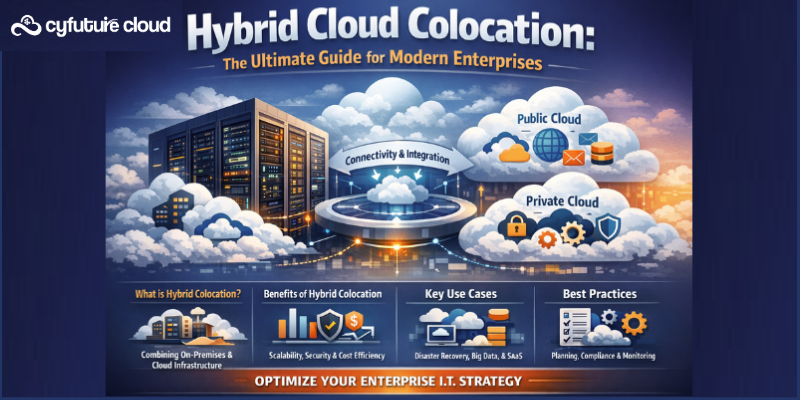

The requirement to store data locally, as per Indian regulations, has been a significant factor driving the growth of new data centre providers and expansion strategies of existing ones. Local data centres improve performance and enable businesses to access high computing resources at a lower cost because data doesn’t need to travel long distances into and out of the country. Currently, 39% of contracted capacity is utilized by hyper-scalers, while colocation makes up the remaining 61%.

Looking ahead, hyper-scalers are expected to adopt a hybrid approach, utilizing both “Own & Operate” and colocation data centres. Sectors like banking, payment services, financial services, and technology are predicted to be the largest consumers of data centre space in the next four years, according to ESDS’ Somani.

The market has witnessed numerous announcements from global hyper-scalers and Indian operators. For example, AWS (Amazon Web Services) announced the launch of its second data centre in Hyderabad, investing $4.4 billion and creating over 48,000 full-time jobs.

“Given the power-intensive nature of the business, this growth will spur demand for green building initiatives and ESG audits. The time is ripe for the country to throw its weight behind machine learning and big data analytics to fully exploit India’s potential to be the capital of Data Centers in Asia.”

Yotta Infrastructure, a part of the Hiranandani Group, is investing Rs 1,500 crore to set up the first of their six Data Center in Noida. This Data Center will have a capacity of 28.8 MW and is expected to start operating in 2024. The Yotta Greater Noida Data Center Park will cover 20 acres of land and offer a total capacity of 30,000 racks. It will have 4 dedicated fibre paths and an IT power capacity of 160 MW.

AdaniConneX, a joint venture between Adani Group and EdgeConneX, plans to establish Data Centers in seven cities across India. These Data Centers will have a combined installed capacity of 1000 MW. The first center, located in Chennai, is already operational with an initial capacity of 17 MW. After completion, it will have a total capacity of 33 MW.

Webwerks, an Indian company, expanded its presence by acquiring a Data Center in Hyderabad. They already have centers in Bangalore and Mumbai. Microsoft, a global major, launched its fourth and largest Data Center in Hyderabad. Additionally, they have data centres in Chennai, Mumbai, and Pune.

IDC estimates that these data centres in India have increased economic output by $9.5 billion and created 1.5 million jobs. Low code platform provider ServiceNow is making an investment in India as well by establishing two data centres in Bangalore and Mumbai. This move aims to boost digital innovation and support the growing tech community in the country.

Growth Triggers Will Continue

The market for data centres will continue to be driven by the expansion of e-commerce and internet services. India has seen a sharp rise in the number of internet users and online transactions, which has prompted the growth of platforms for digital payments, online shopping, and other online services. To manage massive volumes of data, guarantee seamless user experiences, and maintain data security, these platforms need a powerful data centre architecture. In order to make India a desirable location for data centre operators, the government is taking action. Government regulations that demand that data be kept locally (sometimes known as “data localization”) also aid in the market’s expansion.

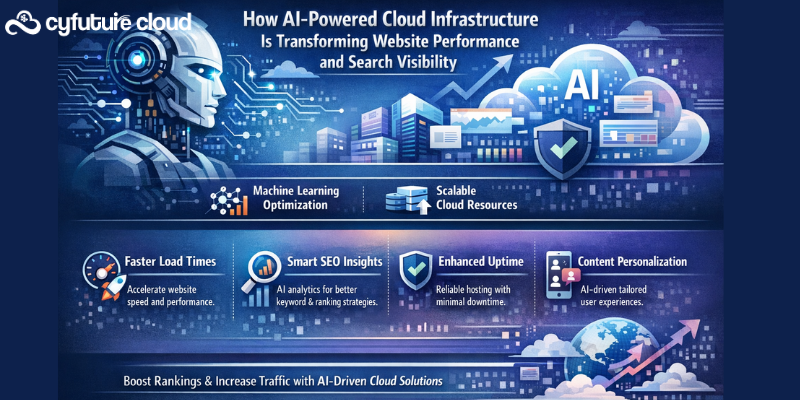

These factors create favourable conditions for data centres to establish and expand their operations in India. Data centre operations will have wide-ranging impacts on various aspects of the country’s development. Kumar from Sify explains that due to the power-intensive nature of data centres, this growth will encourage the adoption of green building initiatives and environmental, social, and governance (ESG) audits. He also thinks that now is the ideal moment for India to concentrate on big data analytics and machine learning in order to fully realise its potential as a major Asian centre for data centres.

Recent Post

Send this to a friend

Server

Colocation

Server

Colocation CDN

Network

CDN

Network Linux

Cloud Hosting

Linux

Cloud Hosting Kubernetes

Kubernetes Pricing

Calculator

Pricing

Calculator

Power

Power

Utilities

Utilities VMware

Private Cloud

VMware

Private Cloud VMware

on AWS

VMware

on AWS VMware

on Azure

VMware

on Azure Service

Level Agreement

Service

Level Agreement