Table of Contents

- Are You Questioning Your Cloud-First Strategy Amid Spiraling Costs?

- What is Data Center Colocation?

- The Great Repatriation: Statistics That Tell the Story

- Why Enterprises Are Choosing Data Center Colocation: The Core Drivers

- The Hybrid Approach: Best of Both Worlds

- Data Center Colocation Market Dynamics: Regional Insights

- The Enterprise Decision Framework: When to Choose Data Center Colocation

- The Cyfuture Cloud Advantage: Enterprise-Grade Data Center Colocation

- Technical Considerations: The Infrastructure Deep Dive

- Common Repatriation Scenarios: Real-World Use Cases

- The AI and Machine Learning Factor: Colocation’s New Frontier

- Regulatory and Compliance Landscape

- Future-Proofing Your Infrastructure Strategy

- Accelerate Your Infrastructure Transformation with Cyfuture Cloud

- Frequently Asked Questions (FAQs)

- 1. Is Data Center Colocation more cost-effective than cloud computing for all workloads?

- 2. What are the typical upfront costs for Data Center Colocation?

- 3. How does Data Center Colocation handle disaster recovery and business continuity?

- 4. Can I integrate Data Center Colocation with my existing cloud infrastructure?

- 5. What level of technical expertise is required to manage colocated infrastructure?

- 6. How quickly can I scale capacity in a Data Center Colocation environment?

- 7. What security certifications should I look for in a colocation provider?

- 8. How does Data Center Colocation support compliance with data sovereignty requirements?

- 9. What network connectivity options are available in Data Center Colocation facilities?

Are You Questioning Your Cloud-First Strategy Amid Spiraling Costs?

Data Center Colocation is experiencing a renaissance as enterprises worldwide discover that the cloud isn’t always the most cost-effective or performance-optimized solution for their critical workloads. This shift represents a strategic recalibration where organizations are moving applications, data, and compute resources from public cloud environments back to colocation facilities—a trend now affecting 83% of enterprise CIOs who plan to repatriate at least some workloads. This comprehensive analysis explores why a growing number of organizations are embracing Data Center Colocation with concrete data and real-world evidence that challenges the “cloud-for-everything” narrative.

Here’s the reality:

The pendulum is swinging back.

After years of aggressive cloud migration, something unexpected happened. CFOs started questioning their cloud bills. CTOs noticed performance bottlenecks. And security teams raised red flags about data sovereignty.

The result? A calculated repatriation.

What is Data Center Colocation?

Data Center Colocation, commonly referred to as “colo,” is a facility where businesses can rent space for servers, storage devices, and other cloud computing and networking hardware. The colocation provider typically furnishes the building, cooling, power supply, voice and data network bandwidth, internet access, and physical security, while the customer provides servers, cloud storage, and network devices. This model eliminates the need for businesses to construct and maintain their own data centers while retaining complete ownership and control over their hardware.

Think of it this way: colocation is like storing your car in a premium garage that provides electricity, security, and climate control—but you still own the vehicle and can customize it however you want.

The Great Repatriation: Statistics That Tell the Story

Let’s cut through the noise with hard numbers:

The Scale of Movement

According to a recent Barclays CIO survey, 83% of enterprise CIOs plan to repatriate at least some workloads in 2024, representing a dramatic increase from 43% in late 2020. This isn’t a marginal shift—it’s a seismic recalibration of IT strategy.

But here’s what matters more:

Slightly more than one-fifth (21%) of workloads and data have been repatriated, according to the Flexera 2026 State of the Cloud Report. While this might seem modest, it represents billions of dollars in infrastructure decisions.

The IDC Perspective

IDC’s June 2024 report, “Assessing the Scale of Workload Repatriation,” found that about 80% of respondents expected to see some level of repatriation of compute and storage resources in the next 12 months.

Here’s what’s critical to understand:

Only 8 to 9 percent of companies plan a total workload repatriation, with the typical picture being that organizations repatriate specific elements of their workloads, such as production data, backup processes, and compute resources.

This isn’t about abandoning the cloud. It’s about strategic optimization.

The Market Data Center Colocation Growth Trajectory

While repatriation accelerates, Data Center Colocation is experiencing explosive growth:

The global data center colocation market size was estimated at USD 69.41 billion in 2024 and is projected to reach USD 165.45 billion by 2030, growing at a CAGR of 16.0% from 2025 to 2030.

In North America specifically, the data center colocation market is forecast to grow by USD 78.56 billion, exhibiting a CAGR of 15.2% between 2024 and 2029.

These aren’t just numbers—they represent thousands of enterprise decisions to reclaim control over their infrastructure.

Why Enterprises Are Choosing Data Center Colocation: The Core Drivers

1. Cost Optimization: The Cloud Bill Shock Phenomenon

Here’s where things get interesting.

In 2025, repatriation is still generally an upward trend, with 86% of CIOs planning to move some public cloud workloads back to private cloud or on-premises—the highest on record for the Barclays CIO Survey.

The math is compelling:

Real-World Cost Comparison:

Ahrefs, a software firm in Singapore, calculated that running its 850 servers in a colocation data center would cost $1.3 million per month, or $39.5 million over 30 months. By comparison, the monthly cost for AWS EC2 instances with equivalent computing power would be $14.9 million, translating to $447.7 million over 30 months.

That’s an 11X cost difference.

Another analysis found that an equivalent workload would cost $118,248 at Amazon and $70,079 in a colocation facility, highlighting the significant cost advantages for high-utilization environments.

The Hidden Cost Structure:

Cloud costs aren’t just about compute. They include:

- Data egress fees

- Storage costs that scale exponentially

- Network transfer charges

- Premium support packages

- Compliance and security add-ons

For businesses operating at scale, cloud costs can easily double the expenses compared with using on-premises infrastructure.

2. Performance and Latency: When Speed Matters

For resource-intensive applications, the difference is night and day.

Enterprises running high-performance computing environments with sustained workloads found that the cloud is not built for sustained high-performance operations, particularly when compared to optimized colocation infrastructure.

Data Center Colocation Performance Advantages:

- Dedicated Hardware: No noisy neighbor problems

- Custom Configurations: Tailor CPU, RAM, and storage exactly to your needs

- Network Control: Direct connectivity to multiple carriers

- Predictable Performance: Consistent resource availability

Cyfuture Cloud’s Tier III colocation facilities deliver 99.99% uptime with N+1 redundancy across power and cooling systems, ensuring mission-critical applications maintain peak performance without the variability inherent in shared cloud environments.

3. Security and Compliance: The Control Factor

Here’s what keeps CISOs awake at night:

Data Sovereignty Concerns:

Industries with strict regulatory requirements—finance, healthcare, government—face complex compliance landscapes. Data sovereignty laws require that sensitive data is stored and processed within specific geographic regions, something that’s easier to guarantee with Data Center Colocation.

Physical Security vs. Virtual Security:

Colocation facilities provide:

- Biometric access controls

- 24/7 armed security personnel

- CCTV surveillance with facial recognition

- Man-trap entry systems

- Cage-level security for individual tenant equipment

Cyfuture Cloud’s colocation data centers feature multi-layered physical security protocols combined with compliance certifications including ISO 27001 and PCI DSS, providing enterprises with the security posture required for regulated workloads.

4. Vendor Lock-In Avoidance: Freedom of Choice

Many IT executives and leaders are now coming to terms with vendor lock-in risks and choosing to implement on-premises or private cloud solutions that mitigate the risk of being unable to easily withdraw data when public cloud providers decide to increase their fees.

Data Center Colocation Provides:

- Hardware independence

- Multi-cloud connectivity options

- Flexibility to change providers

- No proprietary technology dependencies

5. Predictable Expenses: Budgeting with Confidence

CFOs love predictability.

Cloud costs are notoriously variable. About half of cloud buyers spent more on cloud than they expected in 2023, with 59 percent of users predicting similar cost overruns during 2024.

Colocation changes the equation:

- Fixed monthly rack space costs

- Predictable power consumption charges

- Long-term contract stability (typically 1-3 years)

- No surprise egress fees

The Hybrid Approach: Best of Both Worlds

Let’s be clear about something important:

This isn’t about cloud versus colocation. It’s about optimal placement.

Nearly 9 out of 10 organizations use a combination of two or three types of environments (on-premise, public cloud, or private cloud), with 46% reporting they use all three in tandem.

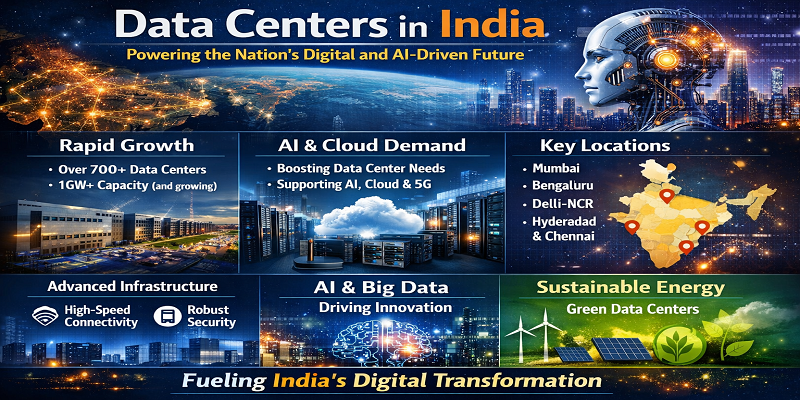

Data Center Colocation Market Dynamics: Regional Insights

North America: The Epicenter

The U.S. data center colocation market size was valued at USD 24.94 billion in 2024 and is expected to reach USD 57.32 billion by 2030, growing at a CAGR of 14.88% during the forecast period.

Geographic Hotspots:

The Southeastern U.S. data center colocation market, which includes states like Virginia, Georgia, and North Carolina, contributed to around 1,193 MW of installed power capacity in 2024, representing over 50% of the installed power capacity in the U.S.

Asia-Pacific: The Growth Leader

In 2024, Asia Pacific represented the largest regional market, accounting for the largest market share of over 41%, driven by rapid digitization initiatives and government cloud infrastructure programs.

The Enterprise Decision Framework: When to Choose Data Center Colocation

Here’s a practical decision tree:

Choose Colocation When:

- Workload Utilization is High: Running servers at 70%+ utilization makes colocation economics compelling

- Compliance Requirements are Stringent: Regulated industries benefit from physical control

- Performance is Critical: Low-latency, high-bandwidth applications thrive in colocation

- Scale is Substantial: The larger your infrastructure, the greater the cost advantage

- Control is Non-Negotiable: Custom hardware configurations and software stacks

Consider Hybrid When:

- Workloads Vary: Some applications need elastic scaling, others need stability

- Geographic Distribution Required: Cloud for global reach, colocation for core operations

- Cost Optimization is Paramount: Use each environment for its strengths

- Risk Mitigation Matters: Diversify across multiple infrastructure types

The Cyfuture Cloud Advantage: Enterprise-Grade Data Center Colocation

Cyfuture Cloud delivers comprehensive Data Center Colocation services designed specifically for enterprises navigating the complexity of hybrid infrastructure:

Infrastructure Excellence:

- Tier III certified data centers with N+1 redundancy

- 99.99% uptime SLAs backed by robust infrastructure

- High-density colocation support for AI and HPC workloads

- Multiple carrier-neutral connectivity options

Operational Superiority:

- 24/7/365 on-site technical support

- Remote hands services for equipment management

- Advanced monitoring and alerting systems

- Customizable security configurations

With over two decades of expertise in the colocation sector, Cyfuture Cloud stands as India’s premier digital infrastructure partner, offering Tier III and ISO-certified facilities with eco-friendly practices and high-efficiency equipment.

Technical Considerations: The Infrastructure Deep Dive

Power and Cooling Architecture

Innovation in power and cooling systems is essential as rack densities surpass 20–30 kW, pushing the need for advanced technologies like liquid cooling, modular power architecture, and energy reuse systems.

Modern colocation facilities provide:

- Redundant UPS systems

- Backup generators with N+1 configuration

- Advanced cooling (CRAC, CRAH, liquid cooling)

- Real-time power monitoring

Network Infrastructure

Connectivity Options:

- Multiple fiber paths for redundancy

- Direct cloud on-ramps to AWS, Azure, GCP

- Internet Exchange (IX) participation

- Cross-connect ecosystems

- Dark fiber availability

Scalability Architecture

Large-enterprise deployments generated 60% of 2024 demand as corporations re-architected around hybrid cloud, but hyperscale customers are pacing future growth at a 20.2% CAGR.

Common Repatriation Scenarios: Real-World Use Cases

Scenario 1: Financial Services Firm

Challenge: Unpredictable cloud server costs for trading platforms

Solution: Migrated core trading infrastructure to colocation

Result: 65% cost reduction with improved latency

Scenario 2: Healthcare Provider

Challenge: HIPAA compliance complexity in multi-tenant cloud

Solution: Moved patient data to secure colocation environment

Result: Enhanced compliance posture, 40% cost savings

Scenario 3: SaaS Company

Challenge: High data egress fees for customer-facing applications

Solution: Hybrid model—colocation for databases, cloud for web tier

Result: 50% reduction in monthly infrastructure costs

Scenario 4: Media Streaming Platform

Challenge: Bandwidth costs crushing margins

Solution: Content delivery from colocation edge locations

Result: 70% bandwidth cost reduction, improved user experience

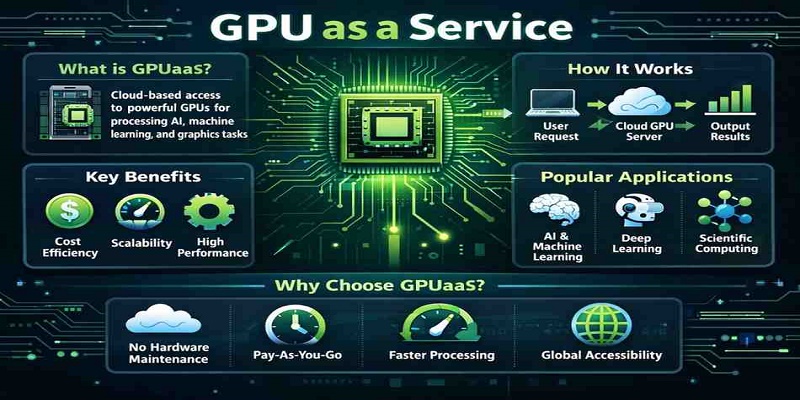

The AI and Machine Learning Factor: Colocation’s New Frontier

Here’s an emerging trend that’s reshaping the landscape:

It’s generally accepted that enterprise AI deployments are too processing-intensive for public clouds. It’s not that public clouds can’t handle AI workloads—it’s just that it’s expensive.

AI Workload Characteristics:

- Sustained high GPU utilization

- Massive dataset storage requirements

- High-bandwidth training pipelines

- Cost-sensitive inference operations

A single generative-AI Platforms cluster may now require contiguous blocks of 10 MW, prompting multi-building campus plans that can scale to 300 MW on day-one land banks.

Cyfuture Cloud’s high-density colocation services are specifically engineered for AI and machine learning workloads, providing the power density, cooling capacity, and network bandwidth required for next-generation compute demands.

Regulatory and Compliance Landscape

Large enterprises prioritize ensuring uninterrupted business operations, especially those handling mission-critical applications such as financial transactions, cloud-based SaaS platforms, and government operations.

Key Compliance Frameworks:

- SOC 2 Type II

- ISO 27001/27017/27018

- PCI DSS Level 1

- HIPAA/HITECH

- GDPR and data residency requirements

- Industry-specific certifications

Cyfuture Cloud’s colocation facilities maintain comprehensive compliance certifications, enabling enterprises to meet stringent regulatory requirements across industries.

Future-Proofing Your Infrastructure Strategy

The technology landscape continues to evolve:

Emerging Trends:

- Edge computing proliferation

- Quantum computing preparation

- Green data center initiatives

- Software-defined infrastructure

- Automation and orchestration

Approximately 60% of enterprises in North America plan to increase their use of colocation services in the next 12-24 months.

Sustainability Considerations:

Modern colocation facilities prioritize energy efficiency:

- Renewable energy sourcing

- Advanced cooling technologies

- Power Usage Effectiveness (PUE) optimization

- Carbon footprint reduction initiatives

Accelerate Your Infrastructure Transformation with Cyfuture Cloud

The data tells a compelling story: Data Center Colocation isn’t just surviving in the cloud era—it’s thriving. As enterprises recalibrate their infrastructure strategies, colocation provides the control, performance, and cost predictability that cloud-first approaches often cannot deliver.

The question isn’t whether to use colocation or cloud. It’s about strategically leveraging both to build infrastructure that’s simultaneously cost-effective, performant, secure, and scalable.

Your Next Steps:

Cyfuture Cloud’s enterprise-grade Data Center Colocation services combine over two decades of industry expertise with state-of-the-art Tier III certified facilities, delivering the infrastructure foundation your business needs to compete effectively in 2026 and beyond.

Partner with Cyfuture Cloud and experience:

- Comprehensive colocation solutions tailored to your workload requirements

- Hybrid infrastructure design expertise

- 99.99% uptime SLAs with N+1 redundancy

- 24/7/365 expert technical support

- Flexible pricing models optimized for your business

The repatriation trend isn’t a rejection of innovation—it’s an embrace of optimization. Transform your infrastructure strategy today by choosing the right platform for each workload, controlling costs without sacrificing performance, and building the foundation for sustainable growth.

Frequently Asked Questions (FAQs)

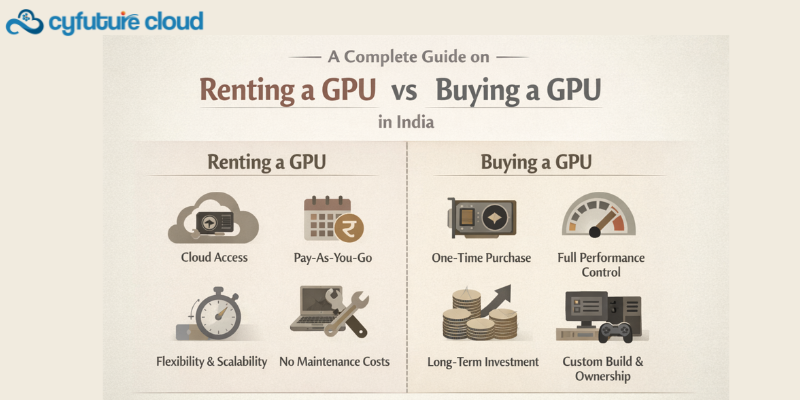

1. Is Data Center Colocation more cost-effective than cloud computing for all workloads?

Not universally. Colocation typically offers superior economics for workloads with high utilization (70%+), consistent resource requirements, and predictable traffic patterns. Cloud computing remains advantageous for variable workloads, short-term projects, and applications requiring rapid geographic expansion. The optimal approach often involves hybrid infrastructure placing each workload in its most economically efficient environment.

2. What are the typical upfront costs for Data Center Colocation?

Upfront costs include hardware acquisition (servers, networking equipment, storage), installation services, and initial setup fees. A typical quarter-rack deployment might require $50,000-$100,000 in hardware costs, plus $2,000-$5,000 in setup fees. However, monthly recurring costs are significantly lower than cloud equivalents for consistent workloads, typically recovering the investment within 12-24 months.

3. How does Data Center Colocation handle disaster recovery and business continuity?

Colocation facilities provide enterprise-grade disaster recovery capabilities including redundant power systems (N+1 or 2N configurations), backup generators, multiple network paths, and geographic diversity options. Enterprises can deploy primary and secondary sites across different colocation facilities, implement real-time data replication, and maintain comprehensive backup strategies—all while controlling their own recovery processes.

4. Can I integrate Data Center Colocation with my existing cloud infrastructure?

Absolutely. Modern colocation facilities offer direct cloud on-ramps providing low-latency, high-bandwidth connectivity to major cloud providers (AWS, Azure, GCP). This enables hybrid architectures where enterprises maintain core infrastructure in colocation while leveraging cloud services for specific use cases, creating optimal cost-performance balances.

5. What level of technical expertise is required to manage colocated infrastructure?

Colocation requires in-house technical capability for server management, application deployment, and infrastructure monitoring. However, many providers including Cyfuture Cloud offer managed services covering routine maintenance, monitoring, and support—allowing enterprises to adjust the management responsibility level based on their team capabilities and preferences.

6. How quickly can I scale capacity in a Data Center Colocation environment?

Scalability timeframes depend on the scope. Adding servers to existing rack space can occur within days. Expanding to additional racks typically requires 1-2 weeks for installation and configuration. Significant expansions requiring additional power and space allocation may need 30-90 days. While not instantaneous like cloud, proper planning enables smooth capacity growth.

7. What security certifications should I look for in a colocation provider?

Critical certifications include ISO 27001 (information security management), SOC 2 Type II (operational controls), PCI DSS (payment card data security), and industry-specific certifications like HIPAA for healthcare. Physical security should include 24/7 surveillance, biometric access controls, multi-factor authentication, and segregated customer environments with cage-level security.

8. How does Data Center Colocation support compliance with data sovereignty requirements?

Colocation provides explicit control over data location, critical for industries with strict data residency mandates. Enterprises can select specific geographic locations for their infrastructure, maintain complete visibility into data storage and processing locations, and implement region-specific security controls—ensuring compliance with GDPR, data localization laws, and industry regulations.

9. What network connectivity options are available in Data Center Colocation facilities?

Enterprise-grade colocation facilities offer carrier-neutral connectivity with multiple options: diverse fiber paths from multiple carriers, direct peering with other customers, Internet Exchange participation, cloud on-ramps for hybrid connectivity, and dark fiber for custom networking. This diversity ensures redundancy, performance optimization, and vendor independence.

Recent Post

Send this to a friend

Server

Colocation

Server

Colocation CDN

Network

CDN

Network Linux

Cloud Hosting

Linux

Cloud Hosting Kubernetes

Kubernetes Pricing

Calculator

Pricing

Calculator

Power

Power

Utilities

Utilities VMware

Private Cloud

VMware

Private Cloud VMware

on AWS

VMware

on AWS VMware

on Azure

VMware

on Azure Service

Level Agreement

Service

Level Agreement