Get 69% Off on Cloud Hosting : Claim Your Offer Now!

- Products

-

Compute

Compute

- Predefined TemplatesChoose from a library of predefined templates to deploy virtual machines!

- Custom TemplatesUse Cyfuture Cloud custom templates to create new VMs in a cloud computing environment

- Spot Machines/ Machines on Flex ModelAffordable compute instances suitable for batch jobs and fault-tolerant workloads.

- Shielded ComputingProtect enterprise workloads from threats like remote attacks, privilege escalation, and malicious insiders with Shielded Computing

- GPU CloudGet access to graphics processing units (GPUs) through a Cyfuture cloud infrastructure

- vAppsHost applications and services, or create a test or development environment with Cyfuture Cloud vApps, powered by VMware

- Serverless ComputingNo need to worry about provisioning or managing servers, switch to Serverless Computing with Cyfuture Cloud

- HPCHigh-Performance Computing

- BaremetalBare metal refers to a type of cloud computing service that provides access to dedicated physical servers, rather than virtualized servers.

-

Storage

Storage

- Standard StorageGet access to low-latency access to data and a high level of reliability with Cyfuture Cloud standard storage service

- Nearline StorageStore data at a lower cost without compromising on the level of availability with Nearline

- Coldline StorageStore infrequently used data at low cost with Cyfuture Cloud coldline storage

- Archival StorageStore data in a long-term, durable manner with Cyfuture Cloud archival storage service

-

Database

Database

- MS SQLStore and manage a wide range of applications with Cyfuture Cloud MS SQL

- MariaDBStore and manage data with the cloud with enhanced speed and reliability

- MongoDBNow, store and manage large amounts of data in the cloud with Cyfuture Cloud MongoDB

- Redis CacheStore and retrieve large amounts of data quickly with Cyfuture Cloud Redis Cache

-

Automation

Automation

-

Containers

Containers

- KubernetesNow deploy and manage your applications more efficiently and effectively with the Cyfuture Cloud Kubernetes service

- MicroservicesDesign a cloud application that is multilingual, easily scalable, easy to maintain and deploy, highly available, and minimizes failures using Cyfuture Cloud microservices

-

Operations

Operations

- Real-time Monitoring & Logging ServicesMonitor & track the performance of your applications with real-time monitoring & logging services offered by Cyfuture Cloud

- Infra-maintenance & OptimizationEnsure that your organization is functioning properly with Cyfuture Cloud

- Application Performance ServiceOptimize the performance of your applications over cloud with us

- Database Performance ServiceOptimize the performance of databases over the cloud with us

- Security Managed ServiceProtect your systems and data from security threats with us!

- Back-up As a ServiceStore and manage backups of data in the cloud with Cyfuture Cloud Backup as a Service

- Data Back-up & RestoreStore and manage backups of your data in the cloud with us

- Remote Back-upStore and manage backups in the cloud with remote backup service with Cyfuture Cloud

- Disaster RecoveryStore copies of your data and applications in the cloud and use them to recover in the event of a disaster with the disaster recovery service offered by us

-

Networking

Networking

- Load BalancerEnsure that applications deployed across cloud environments are available, secure, and responsive with an easy, modern approach to load balancing

- Virtual Data CenterNo need to build and maintain a physical data center. It’s time for the virtual data center

- Private LinkPrivate Link is a service offered by Cyfuture Cloud that enables businesses to securely connect their on-premises network to Cyfuture Cloud's network over a private network connection

- Private CircuitGain a high level of security and privacy with private circuits

- VPN GatewaySecurely connect your on-premises network to our network over the internet with VPN Gateway

- CDNGet high availability and performance by distributing the service spatially relative to end users with CDN

-

Media

-

Analytics

Analytics

-

Security

Security

-

Network Firewall

- DNATTranslate destination IP address when connecting from public IP address to a private IP address with DNAT

- SNATWith SNAT, allow traffic from a private network to go to the internet

- WAFProtect your applications from any malicious activity with Cyfuture Cloud WAF service

- DDoSSave your organization from DoSS attacks with Cyfuture Cloud

- IPS/ IDSMonitor and prevent your cloud-based network & infrastructure with IPS/ IDS service by Cyfuture Cloud

- Anti-Virus & Anti-MalwareProtect your cloud-based network & infrastructure with antivirus and antimalware services by Cyfuture Cloud

- Threat EmulationTest the effectiveness of cloud security system with Cyfuture Cloud threat emulation service

- SIEM & SOARMonitor and respond to security threats with SIEM & SOAR services offered by Cyfuture Cloud

- Multi-Factor AuthenticationNow provide an additional layer of security to prevent unauthorized users from accessing your cloud account, even when the password has been stolen!

- SSLSecure data transmission over web browsers with SSL service offered by Cyfuture Cloud

- Threat Detection/ Zero DayThreat detection and zero-day protection are security features that are offered by Cyfuture Cloud as a part of its security offerings

- Vulnerability AssesmentIdentify and analyze vulnerabilities and weaknesses with the Vulnerability Assessment service offered by Cyfuture Cloud

- Penetration TestingIdentify and analyze vulnerabilities and weaknesses with the Penetration Testing service offered by Cyfuture Cloud

- Cloud Key ManagementSecure storage, management, and use of cryptographic keys within a cloud environment with Cloud Key Management

- Cloud Security Posture Management serviceWith Cyfuture Cloud, you get continuous cloud security improvements and adaptations to reduce the chances of successful attacks

- Managed HSMProtect sensitive data and meet regulatory requirements for secure data storage and processing.

- Zero TrustEnsure complete security of network connections and devices over the cloud with Zero Trust Service

- IdentityManage and control access to their network resources and applications for your business with Identity service by Cyfuture Cloud

-

-

Compute

- Solutions

-

Solutions

Solutions

-

Cloud

Hosting

Cloud

Hosting

-

VPS

Hosting

VPS

Hosting

-

GPU Cloud

-

Dedicated

Server

Dedicated

Server

-

Server

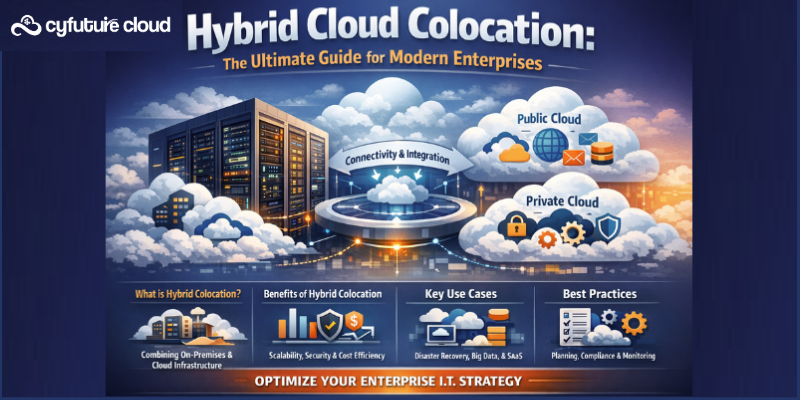

Colocation

Server

Colocation

-

Backup as a Service

Backup as a Service

-

CDN

Network

CDN

Network

-

Window

Cloud Hosting

Window

Cloud Hosting

-

Linux

Cloud Hosting

Linux

Cloud Hosting

-

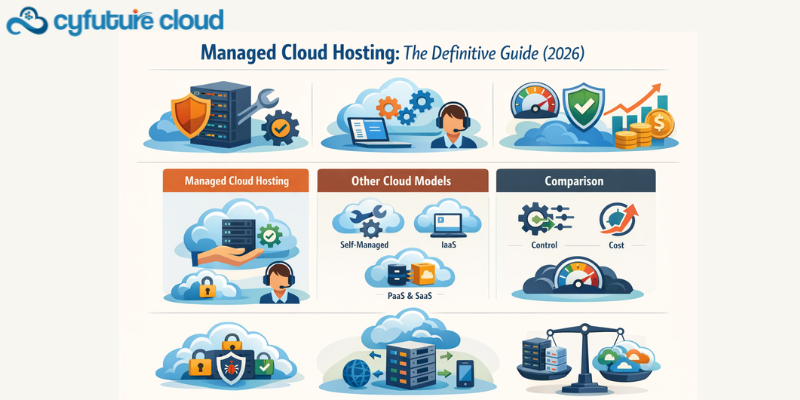

Managed Cloud Service

-

Storage as a Service

-

VMware

Public Cloud

VMware

Public Cloud

-

Multi-Cloud

Hosting

Multi-Cloud

Hosting

-

Cloud

Server Hosting

Cloud

Server Hosting

-

Bare

Metal Server

Bare

Metal Server

-

Virtual

Machine

Virtual

Machine

-

Magento

Hosting

Magento

Hosting

-

Remote Backup

-

DevOps

DevOps

-

Kubernetes

Kubernetes

-

Cloud

Storage

Cloud

Storage

-

NVMe Hosting

-

DR

as s Service

DR

as s Service

-

-

Solutions

- Marketplace

- Pricing

- Resources

- Resources

-

By Product

Use Cases

-

By Industry

- Company

-

Company

Company

-

Company

How is Cloud Computing Helpful in the Banking Sector?

Table of Contents

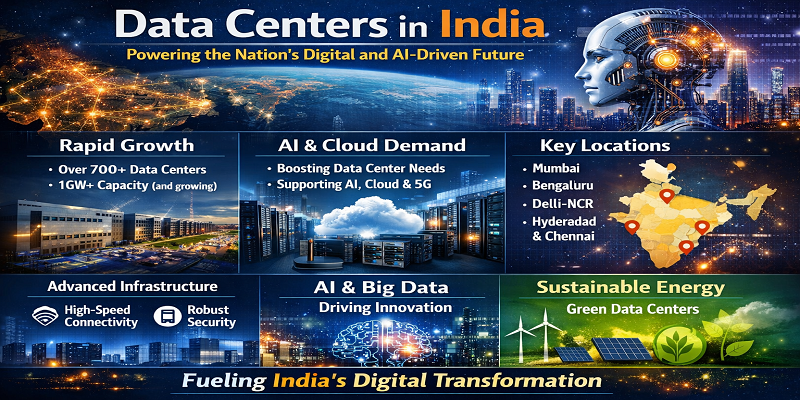

Based on the O’Reilly survey, the adoption of cloud technology across industries is rising at a steady rate of over 90%.

With the rise in cloud computing, several organizations from the banking industry are incrementally migrating to the cloud. As the amount of data produced & consumed increases exponentially, banks are increasingly leveraging cloud services. It helps them to address the need for speed and capacity while centralizing data storage and supporting real-time analytics.

If you, too, are considering cloud services but aren’t sure how the different deployment & operating models fit into your digitalization strategy, then this blog is for you.

How Cloud Computing is Used in Banks

Currently, most banking and financial institutions maintain their cloud using outside service providers, like us – Cyfuture Cloud. We provide our clients with very effective and safe cloud management services.

The survey conducted by Gartner in 2021 indicated that most banks prefer to own internal cloud activities with their internal technical team instead of migrating their work to external cloud service providers.

Also, we have solutions for such concerns. As a cloud service provider, we have built a private cloud where computing resources are housed on a network used by just one enterprise and situated inside our data center.

Some uses for our cloud computing services in banks and other financial institutions include:

Customer Relationship Management (CRM)

Banks use cloud-based CRM systems to handle client data and interactions. Banking and financial organizations can keep track of all customer interactions by using our cloud-based CRM service, no matter where they are or what time of day it is.

Thanks to our ideal cloud techniques, banks may more easily offer customers specialized services based on their demands and preferences.

Fraud Detection

Banks use cloud-based services to detect fraud and how prevent them. By analyzing vast volumes of data from numerous sources, we at Cyfuture Cloud give our banking clients total fraud detection and prevention. This aids in the early detection of questionable activities before any harm is done.

Data Analysis

Banks are using the cloud more frequently for advanced analytics to identify patterns and trends in customer behavior. By examining how customers interact with financial goods, banks may create brand-new solutions that meet customers’ needs more effectively than ever.

Benefits of Using Cloud Technologies in the Banking Sector

Cloud technology in banking has emerged as a catalyst for digital transformation, making banks future-ready. The following are some crucial advantages that we offer by using public clouds for banking and financial services:

- Improved customer experience: Banks can provide a better customer experience by offering anytime, anywhere access to banking services.

- Reduced costs: Banks can save money by moving their applications and data to the cloud. The pay-as-you-go pricing model of public clouds makes it more affordable for financial institutions to use these services.

- Faster processing speeds: Cloud platforms are designed for fast performance and can handle large amounts of data quickly and easily. This allows banks to improve their transaction processing speeds and reduce latency problems.

- Greater scalability: Cloud platforms can scale up or down as needed, which gives financial institutions the flexibility they need to serve their customers best.

- Enhanced security: The public cloud is a more secure environment than most on-premises systems, and it offers multiple layers of protection against data breaches and other attacks.

- Compliance with regulations: Banks can meet regulatory compliance requirements by using cloud platforms that are compliant with financial industry regulations.

- Centralized Data Repository: Cloud platforms enable seamless integration of disparate business data and operational systems with secure & easy data sharing. It creates centralized and connected data to drive integrated decisions and solve customer problems more quickly.

- Disaster Recovery: The most significant benefit of transitioning to the cloud is its robust disaster recovery with integrated redundancies. With the financial world moving at a much faster pace, the cloud allows banks to streamline opportunities, meet customer expectations and operate at the speed of business by regaining access to actionable insights in case of disruptive events or natural disasters.

- Access to Powerful Data Management Capabilities & API Ecosystem: Advanced analytics and cloud API ecosystem allow banks to meet the changing demands of customers with open banking. Banks and financial services can also optimize their reconciling efficiency and cash and liquidity management.

- Increased Efficiency: Financial services firms can streamline operations and increase efficiency by using cloud technologies. By linking customers and sellers on a single platform, payment processes can be made even simpler. This makes data tracking and transaction speed improvements.

- Business Continuity: Cloud computing can assist banks and financial services firms with increased data protection, fault tolerance, and disaster recovery for financial firms. It provides a high level of redundancy and backup at a comparatively lower price than traditional managed solutions.

- Agility and Transformation: Financial organizations can experience shorter development cycles for new products through flexible cloud-based operating models. The related technology supports a faster and more efficient response to the needs of modern banking customers. It enables businesses to shift non-critical services, including maintenance, software patches and other computing issues. This helps financial firms focus more on business growth.

Partner with Cyfuture Cloud for Your Cloud Journey

In the past, the financial sector has been slow to adopt new technologies, but things are different; financial institutions are now starting to embrace cloud computing to become more efficient and effective at serving their customers’ needs.

The use of cloud computing allows banks and other financial firms to deploy applications swiftly without worrying about hardware maintenance or software upgrades.

At Cyfuture Cloud, we provide our cloud computing services to the banking and financial industry. We analyze the client’s pain points and business objectives; then, we work with them to co-create a custom-fit solution for your business.

Are you ready to achieve digital transformation for your banking or financial institution? Call us to talk with a professional!

Recent Post

Stay Ahead of the Curve.

Join the Cloud Movement, today!

© Cyfuture, All rights reserved.

Send this to a friend

Pricing

Calculator

Pricing

Calculator

Power

Power

Utilities

Utilities VMware

Private Cloud

VMware

Private Cloud VMware

on AWS

VMware

on AWS VMware

on Azure

VMware

on Azure Service

Level Agreement

Service

Level Agreement