Table of Contents

- What Does Insurance Cloud Computing Refer to?

- Key Benefits of Cloud Hosting in Insurance

- What are the Challenges Insurance Companies Face When Using Cloud Computing?

- How to Mitigate These Challenges and Risks?

- Examples of Insurance Industry Cloud Technology

- Challenges of Implementing Cloud Technology in Insurance

- Importance of Cloud Security in Insurance:

- The future is where the Cloud is for insurers!

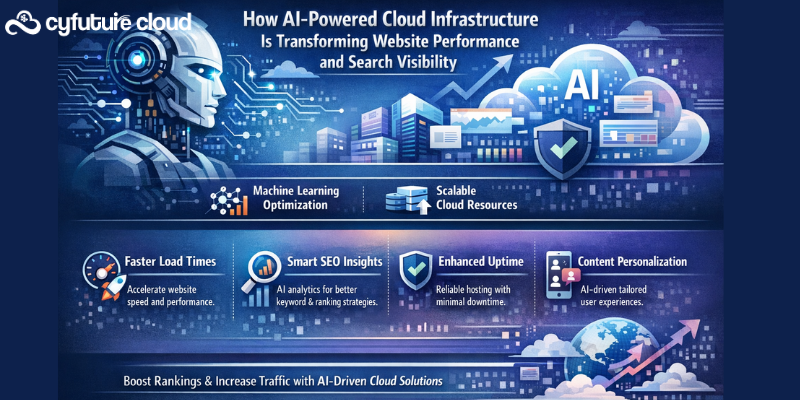

The cloud computing insurance sector, often considered traditional and risk-averse, is undergoing a remarkable transformation through the adoption of cloud hosting solutions. Cloud technology is not only changing the way insurance companies operate but also how they serve their customers.

Insurance firms may adopt cloud hosting to store, process, and access their data and applications on remote servers via the Internet. This provides cost savings, increased efficiency, data security, and flexibility. By leveraging cloud technology, insurers can streamline their operations. It improves consumer experiences while remaining competitive.

In this blog, we’ll delve into the workings of cloud hosting in the cloud computing in insurance industry and understand the benefits it brings to this complex and data-driven field.

What Does Insurance Cloud Computing Refer to?

The use of cloud technology in the insurance industry is referred to as insurance cloud computing. It enables insurance businesses to store, process, and access their data and applications via the Internet on distant servers. It’s similar to reserving a hotel room that you don’t own but can use all of its facilities throughout your visit. To get the benefits of insurance cloud computing, businesses just need an internet connection and a membership cost.

This technology is aimed at insurers and provides solutions. Including claims management, underwriting, and API integration. Cloud computing in insurance industry has a significant impact. Insurance businesses may simplify their processes by embracing cloud computing. It saves on infrastructure costs and gains scalability and flexibility.

It facilitates data management by storing vast amounts of consumer data securely. This is available at any time and from any location. It improves internal operations, attracts new consumers, and ensures policyholder loyalty. It also encourages agents, underwriters, and claims adjusters to work together. It promotes industrial innovation and digital transformation.

Gartner data shows a significant increase in the volume of the cloud computing technology industry. It estimates a rise from 1.3 trillion dollars in 2022 to 1.8 trillion by 2025.

Companies across industries are focusing on cloud computing expertise, seeing its benefits. This technology helps transform business processes and production dynamics in the insurance industry. Relationships with consumers, staff, and suppliers are also important.

Key Benefits of Cloud Hosting in Insurance

1. Cost Efficiency

Traditional data centers and infrastructure can be expensive to set up and maintain. With cloud hosting, insurance companies can reduce capital expenses, as they no longer need to invest in physical servers and on-site hardware. They can instead pay for the resources they use, resulting in cost savings.

2. Scalability

Insurance needs fluctuate due to seasonal variations and market demands. Cloud hosting allows insurance companies to scale their resources up or down quickly. For example, during open enrollment periods, insurers can easily increase their server capacity to handle higher website traffic.

3. Data Security

The insurance industry handles sensitive and personal data. Due to which it requires cloud storage for strict security & privacy. Cloud hosting providers offer robust security measures, including encryption, firewalls, and intrusion detection systems. This ensures data protection and compliance with industry regulations, such as HIPAA for health insurance.

4. Disaster Recovery

Insurance companies deal with the unexpected every day. Cloud hosting ensures that data is regularly backed up and can be quickly restored in case of data loss, ensuring business continuity even in the face of disasters.

5. Customer-Centric Services

Cloud hosting enables insurers to provide better customer experiences. Policyholders can access their accounts, file claims, and receive support through web-based portals and mobile apps. This convenience fosters stronger customer relationships.

6. Data Analytics

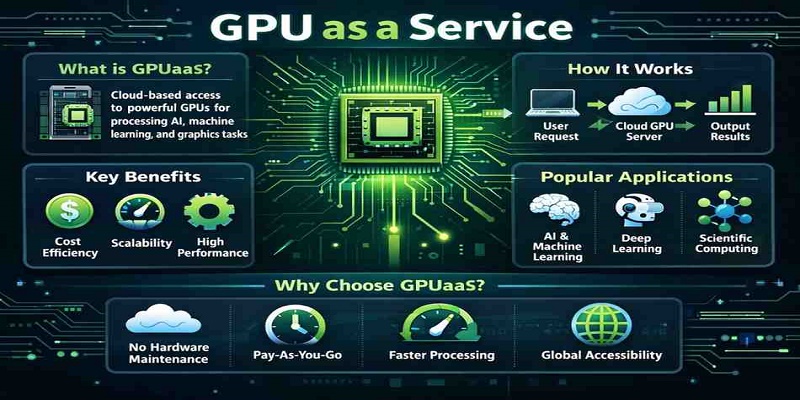

The insurance industry thrives on data analysis. Cloud hosting offers the computing power needed to process vast amounts of data for risk assessment, fraud detection, and pricing optimization. Insurers can leverage artificial intelligence and machine learning algorithms to make more accurate underwriting decisions.

What are the Challenges Insurance Companies Face When Using Cloud Computing?

While cloud computing provides advantages in the insurance sector, difficulties such as legacy systems, data security, and dependability must be addressed. The obstacles and hazards of implementing cloud technology in the insurance sector are as follows. Includes:

Reluctance to Let Go: Many insurance firms are hesitant to ditch their outdated systems. Maintaining and integrating new cloud systems may be pricey.

Data Security Concerns: Insurance companies deal with sensitive data that must be kept secure when stored in the cloud storage. Particularly when utilising public clouds, where data security may be less than in private clouds.

Concerns about reliability: Insurance firms need confidence that their data will be available when needed. So the cloud provider won’t experience significant downtime or shutdowns.

Availability challenges: Businesses may have challenges with the availability of cloud services. Servers may be inadequate or positioned too far away from the insurance company’s headquarters.

Privacy and Control: When utilising cloud services, be sure that your privacy is protected. It also retains control over data, which may be difficult with public clouds.

Vendor Selection: Cloud providers differ in terms of computer power, responsiveness, storage capacity, and dependability. To achieve unique business objectives, selecting the correct provider becomes crucial. Furthermore, insurers may be trapped into a single cloud provider due to the high cost of moving.

Internal Difficulties: Technical challenges might stymie the adoption of cloud technologies within insurance businesses. It can lead to change aversion, reliance on old systems, and reliance on non-cloud technologies.

How to Mitigate These Challenges and Risks?

Insurance businesses should focus on the following to tackle these issues and risks:

- Understanding their business requirements is a driving reason behind cloud adoption.

- Creating a comprehensive managed cloud strategy and migration plan.

- Assigning specialised teams and outlining roles and duties for migration management.

- Establishing a robust governance structure.

- Identifying key performance indicators (KPIs) to measure cloud performance.

- Providing staff training on best practices for utilizing cloud services effectively.

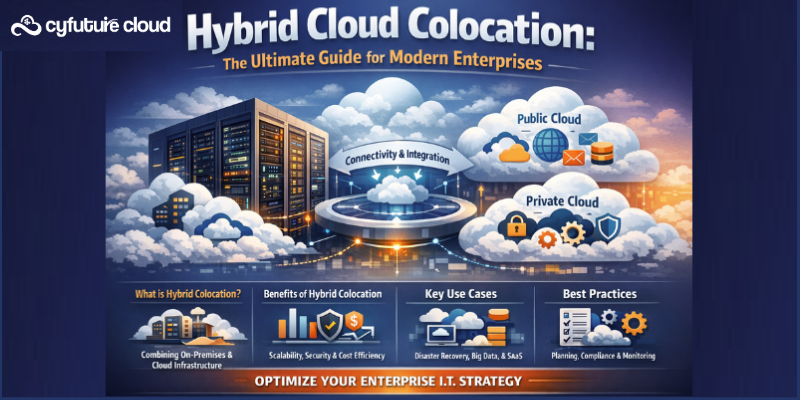

- Choosing the most appropriate cloud model that meets the needs of the insurance company and its clients.

Examples of Insurance Industry Cloud Technology

Cloud computing is being used by insurers across a wide variety of important systems and functions:

Cloud-Based Claims Processing Systems

Automated processes are included into cloud-based claims management systems to speed up processing and settlement. Mobile claim submissions, AI-powered fraud detection, real-time progress tracking, and straight-through claims processing without user involvement are among the key capabilities.

Cloud-Based Policy Management Systems

Cloud policy admin systems centralize all policyholder data and documents into one platform for efficient servicing. Key features include flexible policy rating, rules-based underwriting, multi-channel digital distribution of policies, and data-driven insights from analytics.

Cloud-Based Customer Relationship Management (CRM) Systems

Cloud CRM tools like Salesforce consolidates all prospect and customer data to create 360-degree views. CRM analytics also uncover upsell/cross-sell opportunities. Cloud-based CRMs optimize sales processes and improve customer retention.

Cloud-Based Data Analytics Tools

Powerful cloud data warehouses and business intelligence software perform data mining at immense speeds. Insurers gain analytics-driven insights on risk exposure, fraud patterns, customer behavior, operational performance, underwriting results, and more.

Challenges of Implementing Cloud Technology in Insurance

Although usage is increasing, insurers encounter challenges when migrating traditional systems to the cloud, which must be properly managed:

Data Privacy and Security Concerns

Insurers handle highly sensitive customer data related to health, finances, assets, and medical history. Strict data protection laws apply. Assuring compliance, encrypted security, and access controls are top priorities for avoiding breaches during cloud migration.

Integration with Legacy Systems

Most insurers have dense on-premise IT ecosystems built up over decades. Seamlessly interconnecting cloud and legacy platforms for smooth data flows and processes is difficult. APIs are key integration enablers.

Resistance to Change Among Employees

For staff accustomed to legacy environments, adopting cloud systems can require new skill sets. User adoption requires change management through training and internal marketing. Customers may first be hesitant to trust cloud-based insurance services.

Regulatory Compliance Issues

Insurers must ensure that cloud providers follow all applicable requirements on data security, privacy, risk management, and governance. Confirming compliance across different jurisdictions is an obstacle for global insurance companies.

Importance of Cloud Security in Insurance:

Cloud security is paramount in the insurance sector due to the sensitive nature of customer data, policy information, and financial records stored in the cloud. Ensuring robust security measures is crucial to safeguard against cyber threats, data breaches, and compliance risks.

| Aspect | Importance of Cloud Security in Insurance |

|---|---|

| Data Protection | Safeguards sensitive customer data, policy information, and financial records from unauthorized access or breaches. |

| Compliance | Ensures adherence to industry regulations (e.g., GDPR, HIPAA) for data protection and privacy, avoiding penalties and legal issues. |

| Risk Mitigation | Minimizes cyber threats, such as ransomware attacks or phishing, reducing the potential for financial losses and reputational damage. |

| Trust and Reputation | Upholds trust with policyholders by demonstrating a commitment to robust security practices, maintaining a positive industry reputation. |

| Continuity | Ensures uninterrupted service delivery and availability of insurance platforms, preventing downtime that could impact operations. |

The future is where the Cloud is for insurers!

The cloud computing insurance industry and its role for the people are in the midst of a transformation. What was once about calculating premiums and managing costs is now about investment, prevention, and experience. Companies leading this transformation put data at the core of everything they do, enhancing experience from end to end. Cloud computing in insurance industry reinforces the move by creating the way for on-demand business scalability, removing resource limits to enable more complex capabilities, detecting signs of business change, and controlling prices. As a result, insurers must embrace the cloud, not if but when.

Migrating to the cloud may appear to be an expensive undertaking for insurers, but it will provide beneficial returns in the future. Companies that adopt a proactive strategy early on will gain a competitive edge. Those who are averse to change may struggle to compete on equal footing with their competitors.

Recent Post

Send this to a friend

Server

Colocation

Server

Colocation CDN

Network

CDN

Network Linux

Cloud Hosting

Linux

Cloud Hosting Kubernetes

Kubernetes Pricing

Calculator

Pricing

Calculator

Power

Power

Utilities

Utilities VMware

Private Cloud

VMware

Private Cloud VMware

on AWS

VMware

on AWS VMware

on Azure

VMware

on Azure Service

Level Agreement

Service

Level Agreement